In 3 charts: The UK jobs recovery has a dark side

Despite a recent and rapid drop in the UK’s unemployment rate, an international comparison by the Office for National Statistics (ONS) today recalls the dismal aspects of the UK labour market.

The recent drop in unemployment for the UK is certainly impressive, especially in comparison to stubbornly high Eurozone unemployment rates. British unemployment plunged from a 7.9 per cent high early in 2013 to 7.1 per cent in November, dropping by 0.6 percentage points in the space of four data releases.

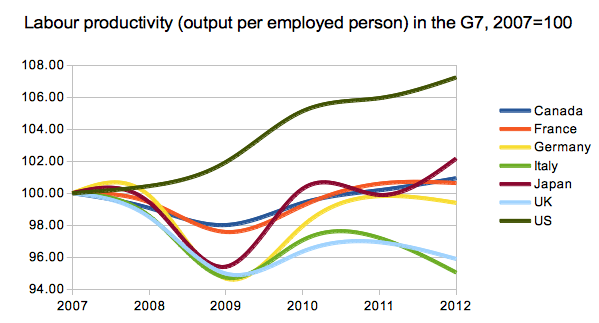

But on productivity, the UK picture is dire. Rebasing the ONS data for output per employed person to 2007 shows the UK outperforming only Italy. Unlike Italy, which had relatively poor productivity growth prior to the financial crisis, the UK performed well up until 2008, and has slumped since.

The TUC’s Duncan Weldon has recently written on the UK’s dreadful productivity issues, and low weekly earnings growth:

The UK was always going to face difficult productivity headwinds in the years after 2008. The slow decline of the offshore North Sea sector (a hugely productive sector) coupled with less risk taking from the financial sector (and there’s an interesting and live debate on the extent to which productivity increases in this sector where ‘real’) knocked away to important components of productivity growth.

The US picture is almost unbelievable: productivity has continued to surge upward, with the crisis barely denting the output of American workers.

On pay, the data show that between the Millennium and 2007, the UK was far and away the G7’s best performer in terms of real wage increases.

But in the years since the crisis, the UK has atrophied in terms of real wages – second only to Japan and Italy again.

While US real wages have not risen at the stunning pace of productivity, they are marginally above 2007 levels. Canada, the best performer included by the ONS, has seen rising real wages in every year since the crisis, which the country weathered particularly well.