Russian retail giant Lenta set for London float

RUSSIA’S second biggest hypermarket chain Lenta has become the latest retailer to take part in this year’s IPO revival after announcing plans to float on the London Stock Exchange as early as next month.

Lenta, which has 77 hypermarkets and 10 supermarkets in 45 cities across Russia, is aiming to raise finance as it looks to expand and double in size over the next three years.

The listing, which could value the business at more than £3bn, will also give the retailer’s majority shareholder, the US private equity firm TPG, a chance to cash in on its investment four years after buying its stake.

TPG owns a 49.8 per cent interest while the European Bank for Reconstruction and Development (EBRD) holds a 21.5 per cent stake, and the Russian Bank VTB has an 11.7 per cent stake.

Chief executive Jan Dunning told City A.M.: “[Lenta’s shareholders] have listened carefully to the banks and made up their mind that it is a good moment to float. We have seen strong growth over the last couple of years and it will help us get more exposure.”

Dunning said Russia’s retail market was highly fragmented with the country’s top five retailers accounting for around a fifth of the overall market.

“This is a remarkable level when compared with countries like Germany and the US. There is an opportunity for top players to develop and we want to be a part of that,” he said.

News of the float came as the retailer reported a net profit of 7.1bn roubles (£123m), up 38 per cent from the previous year on sales of 144.3bn roubles.

Lenta’s shares will trade as global depositary receipts (GDRs) and it also intends to list in Moscow if the London float proves successful.

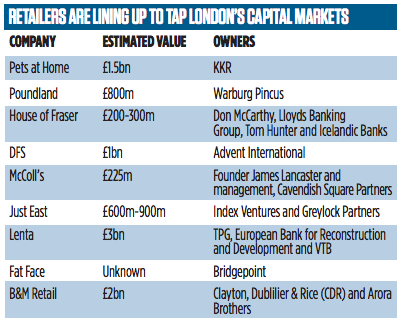

The company joins as many as 15 UK and overseas retailers looking towards an IPO this year, including German wholesaler Metro, which plans to sell part of its Russian cash-and-carry unit.