US auto sales drag on sales growth

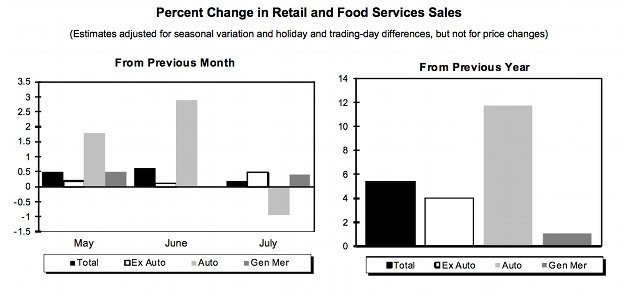

US retail sales increased by a weaker-than-expected 0.2 per cent in July to $435.5bn, following an upwardly revised 0.6 per cent increase the month before and predictions of a 0.3 per cent rise.

This was the fourth consecutive month of growth, and resulted in the dollar rising against other major currencies.

Taper on? UST 10Y yield jumps from 2.673% to high 2.693% following improved US Advance Retail Sales (JUL). $USDJPY at high of 98.25.

— Christopher Vecchio (@CVecchioFX) August 13, 2013

Growth was driven by a 1.0 per cent increase in sporting goods, hobby, book and music stores, and a 0.9 per cent boost for gasoline stations and clothing stores. This was partially offset by a 1.1 per cent decrease in auto sales.

Excluding automobiles, however, retail sales beat expectations, rising by 0.5 per cent – the highest this year – following an upwardly revised 0.1 per cent growth the month before. Analysts had expected to see a 0.4 per cent rise.

Compared to July 2012, retail sales rose by 5.4 per cent – primarily driven by a 13.3 per cent boost in auto sales. Over the year to July, the only businesses to see a fall in sales were department stores (4.8 per cent) and electronics and appliance stores (0.4 per cent).

Consumer spending accounts for approximately 70 per cent of US economic activity.

Goldman Sachs said it would keep its third quarter GDP expectations unchanged at 2.0 per cent.

Paul Dales, senior US economist at Capital Economics, says the data is better than it would first appear given the skewing effect that auto sales had on the monthly figure. The "core" growth of 0.5 per cent month-on-month is very encouraging, he says, suggesting that real consumption growth may accelerate from 1.8 per cent in the second quarter to at least 2.5 per cent in the third.

As such, this report shows that households may be spending a bit more freely in response to the recent gains in employment, equity prices, house prices and the modest loosening in credit criteria.

US unemployment fell to a four and a half year low of 7.4 per cent in June, although employers added a modest 162,000 more jobs.