Comcast in $45bn swoop for Time Warner Cable

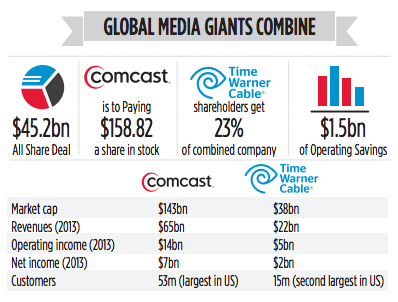

US TV giant Comcast yesterday agreed to buy smaller rival Time Warner Cable (TWC) for $45.2bn (£27.1bn), the biggest M&A deal of the year so far.

The agreement, which still needs to be approved by regulators and shareholders, will create America’s largest cable and broadband provider, with combined revenues of $87bn and a market cap of $180bn.

The “friendly, stock-for-stock deal”, as it was termed yesterday, will see Comcast pay TWC shareholders 2.875 Comcast shares for each TWC share, equal to $158.82 a share. This is a 17.4 per cent premium to TWC’s close price on Wednesday.

Concerns yesterday turned to regulators who will scrutinise the deal, and its impact on consumers. Comcast and TWC moved to ward off concerns it would dent competition.

“Significantly, it will not reduce competition in any relevant market because our companies do not overlap or compete with each other,” Comcast boss Brian Roberts said.

Comcast said it will cut three million subscribers it will inherit from TWC, taking the managed numbers of subscribers with the company to just under 30 per cent of the market.

The deal, which was signed off by both boards of directors at 1:30am yesterday morning, ends the long-running pursuit of TWC, which was being courted with a rival bid from Charter Communications. Charter, backed by media magnate John Malone, previously had a $132.50 offer turned down by TWC.

Shareholders like hedge fund manager John Paulson, whose firm Paulson & Co is a top shareholder in TWC, backed the deal with Comcast yesterday, referring to it as a “dream combination”.

The deal, which is the third largest M&A deal since the financial crisis, will also benefit financial advisers. TWC’s deal makers Morgan Stanley and Citi are set to share an estimated $57m to $75m. JP Morgan and Barclays could pocket $51m to $68m after working for Comcast, according to Thomson Reuters.