City investors finalise plans for RBS branch bid

ONE OF the bidders vying for a shot at winning a portfolio of RBS branches is expected to submit a formal offer for the network this morning, after listing on the London stock market to fund the deal.

W&G Investments, headed up by former Tesco finance chief Andy Higginson and backed by institutions including Schroders and Threadneedle, floated on Aim this morning, with each backer committing ahead of the flotation to take at least a three per cent stake in the vehicle.

But rivals battling to buy the 316 branches from RBS are pushing hard to show they have the best chance of seeing the deal through and setting up a viable challenger bank, City A.M. understands.

Key factors in deciding who can buy the so-called Project Rainbow branches are the price and the ability to complete the deal.

RBS is also expected to consider other factors, including longer-term performance and the type of bank the new institution will become. Tesco Bank was initially run as a joint venture with RBS, meaning Higginson has experience of buying a unit from RBS and running it as a standalone lender.

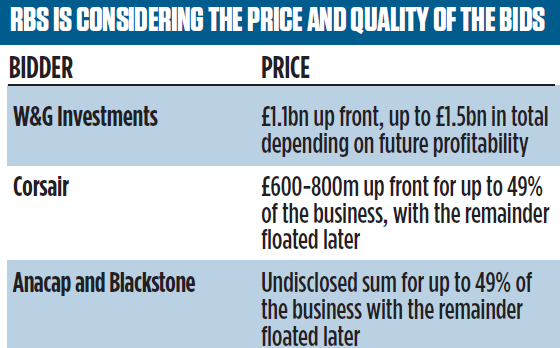

W&G is offering RBS £1.1bn in cash upfront for complete ownership of the branches, and depending on future performance will also pay up to £400m more over the following years.

A rival consortium headed by Corsair is offering £600m to £800m for a stake of up to 49 per cent in the branches. It will then work with RBS to split off the unit, and run an initial public offering to sell the remainder. The third bidder is a group headed by Anacap and Blackstone.