Growing business confidence kickstarting IPO recovery – Capita

The London initial public offering (IPO) market is recovering from the "hangover" of the financial crisis, but we're still a long way off the "glory days", Capita has said.

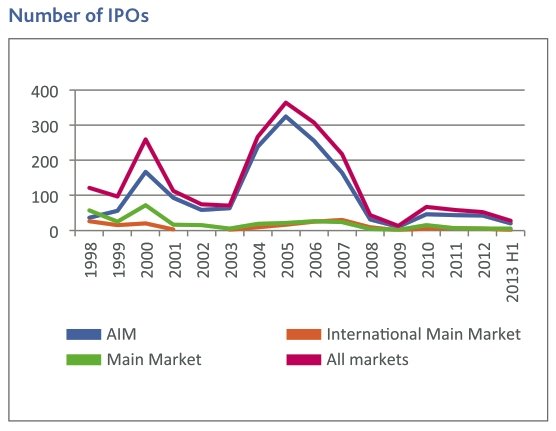

By Capita's calculations, 53 companies undertook an IPO in 2012 – the second worst year on the domestic main market of the last fifteen years (after just 13 companies in 2009). By comparison, the record year of 2006 saw £25.6bn of shares sold in 307 IPOs.

Source: Capita

However, Capita expects 2013 to be much stronger – with the domestic market already having reached £1.8bn in the first half. The international market and AIM have added another £724m, bringing the total to £2.6bn.

And with the flotation of the Royal Mail in the second half – likely to make the list of top ten IPOs from the last 15 years (see below), the full year total could hit £7.8bn – which would make 2013 the second best year for IPOs since 2007.

Capita is even more optimistic about 2014, which should see "the best deal flow in years" – around 50 per cent higher than in 2013, even with this year's Royal Mail float.

Justin Cooper, chief executive of Capita Registrars, said:

With the FTSE All-Share near all-time highs, and economic recovery slowly beginning to take hold, company managers can command higher valuations for their firms and will be more confident about becoming listed entities. It takes several months to plan a listing so the deal pipeline will now be filling nicely.

A healthy IPO market is crucial to the long term functioning of the economy and the financial system. It is a vital route for entrepreneurs to the all important exit from the firms they have built and helps ensure capital is efficiently allocated. Companies tend to mature and fade over time, or get taken over and delisted, so new blood is necessary to provide pension funds, insurance companies and private investors with places to put their money. The flotation of Royal Mail is the first in a series of mooted large new issues over the next couple of years. The return of the IPO is much to be welcomed.