Here’s why one analyst is getting excited about M&S

Marks & Spencer shares have jumped this morning after investment bank Jefferies upgraded the stock to reflect the retailer’s new online street cred.

M&S, which has been battling to turn around its clothing business in the face of massive competition on the high street and online, has seriously impressed Jefferies with its new “industry-leading” website, launched yesterday.

“The customer interface is significantly improved with more video content, 50 per cent bigger pictures and a streamlined look,” the analyst said in a note upgrading M&S from hold to buy, with a target price moved from 480p to 600p.

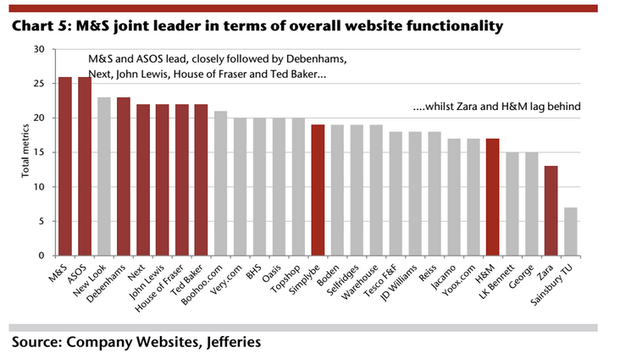

In the name of research, Jefferies analysts have ranked almost every UK fashion site for its functionality, and believe that M&S now equals Asos and beats pretty much anyone else selling clothes in Britain today.

M&S makes around 20 per cent of its sales online and Jefferies thinks the firm can lift its multi-channel sales by 30 per cent in the next financial year.

Though M&S' track record for sustainable sales and profit growth is undeniably patchy, we believe the combination of an improved website, an improved delivery offer (to come), a quality product range at attractive prices, improved UK consumer confidence, supportive FX moves and good opex control should lead to a step change in M&S' operating performance.