UK public sector runs up first July deficit in three years

The Office for National Statistics said the UK had a £62m deficit in July, compared to a £823m surplus the previous year. This is the first July deficit in three years (note that July last year was initially reported as a deficit but now revised), and came as a surprise to analysts (release).

Excluding one-off cash transfers from the Bank of England and Royal Mail, public borrowing totalled £36.8bn pounds in the first four months of the 2013/14 fiscal year. This is up from £35.2bn in the same period the year before.

July usually experiences a surplus, being a big month for income and corporate tax reciepts. However, this month saw a fall in receipts from the offshore oil and gas sector, and exposed a significant growth in government spending.

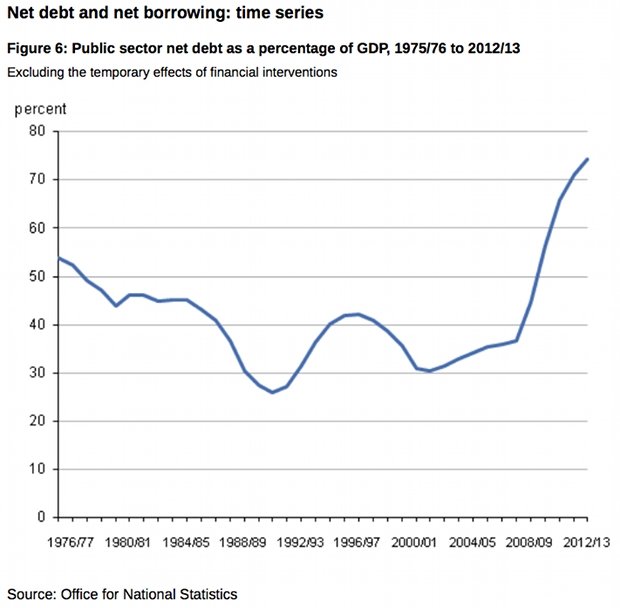

Spending by the government rose above even the 3.4 per cent increase in tax receipts this year (budget forecast 3.0 per cent rise). Note that corporate tax receipts fell by 1.4 per cent to £7bn. The UK's national debt excluding bank support is now equivalent to 74.5 per cent of gross domestic product (GDP).

- In 2012/13, public sector net borrowing excluding temporary effects of financial interventions and also excluding the effects of the transfer of the Royal Mail Pension Plan and the transfers from the Bank of England Asset Purchase Facility Fund was £116.5 billion. This was £2.0 billion lower than in 2011/12.

- In 2012/13, public sector net borrowing excluding temporary effects of financial interventions (PSNB ex) was £82.1 billion. This was £36.4 billion lower than in 2011/12 when it was £118.5 billion.

- In July 2013, public sector net borrowing excluding temporary effects of financial interventions and also excluding the effects of the transfers from the Bank of England Asset Purchase Facility Fund was £0.5 billion. This was £1.3 billion higher than in July 2012 when it was £-0.8 billion (a surplus).

- In July 2013, public sector net borrowing excluding temporary effects of financial interventions (PSNB ex) was £0.1 billion. This was £0.9 billion higher than in July 2012 when it was £-0.8 billion (a surplus).

- In July 2013, of the £5.3 billion transfered from the Bank of England Asset Purchase Facility Fund to HMT Treasury £0.4 billion reduced the public sector net borrowing excluding temporary effects of financial interventions (PSNB ex).

- Public sector net debt excluding temporary effects of financial interventions (PSND ex) was £1,193.4 billion at the end of July 2013, equivalent to 74.5% of gross domestic product (GDP).

- In April, May and June 2013 the central government net cash requirement has increased by £3.9 billion in each month because of a correction to data. The central government net cash requirement for the 2013/14 year to date was £19.0 billion, £4.9 billion lower than the same period in 2012/13.