Two innovative ideas to cut your premiums

THE INSURANCE market is not always seen as the most innovative sector, but this reputation may be undeserved. Major institutions, as well as new market entrants, increasingly provide inventive ways of helping you bring down your premiums.

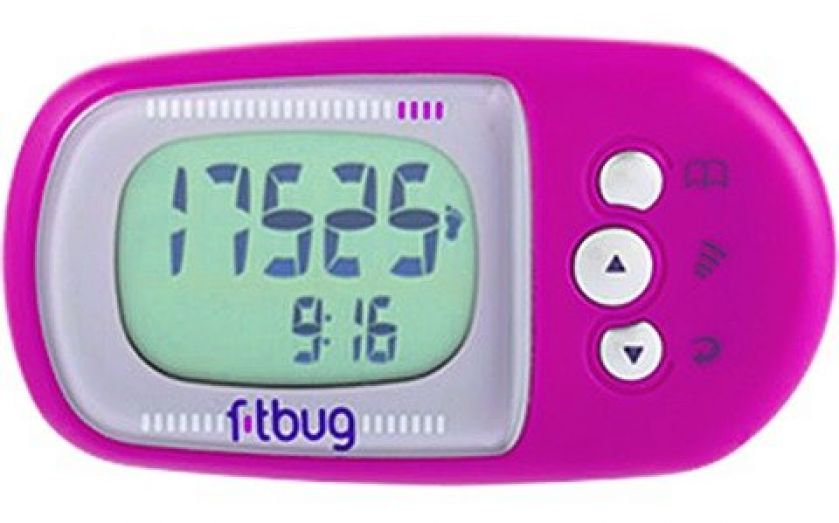

The rise of wearable technology – including fitness gadgets that track activities such as steps taken, calories burned and other metrics – has begun to allow private health insurers to financially incentivise exercise. Graeme Godfrey of insurance adviser Best Go Private highlights PruHealth’s Vitality scheme. Policy-holders can claim as much as 15 per cent of their annual premium back by living a healthy lifestyle. Data from heart rate monitors, pedometers and various other devices allows the company to allocate “vitality points” to individuals. Exercising at 60 per cent of the age-related maximum heart rate for 60 minutes, or 70 per cent of the maximum 30 minutes just four times in a week gives access to the higher range of benefits. On the employer scheme, this amount of exercise also leads to an elimination of the £250 excess on claims. PruHealth’s Nick Read says, “it is key that data is incorporated as a core part of the policy, rather than as a bolt-on.” The vitality scheme is currently the only programme linking data to a reduction in premiums.

But some groups with unusual insurance needs have historically found it difficult to access insurance altogether. Owners of pug dogs, for example, find it difficult to protect against the high probability of the theft of this expensive breed. Bought By Many, a startup founded in 2011, allows these groups to club together and negotiate as a collective. According to company co-founder Guy Farley, the system now has over 5,500 members, and has negotiated deals with 11 different insurers at discounts ranging from 7.5 to 20 per cent of initial quotes. By bypassing price comparison sites, Bought By Many allows insurance companies to reduce their distribution costs, a saving which can be passed on to consumers.

LIAM WARD-PROUD