London Report: Vodafone talks power rebound for FTSE shares

BUMPER gains among telecom stocks powered a rebound in UK shares yesterday after Vodafone confirmed it was in talks with Verizon to sell out of its US joint venture.

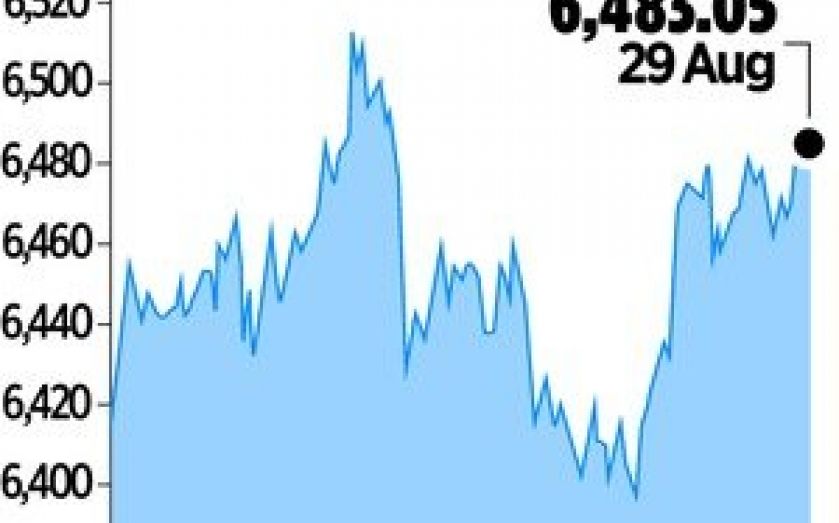

The FTSE 100 closed up 0.82 per cent, or 52.99 points at 6,483.05, bouncing back again after falls over the last two days.

Vodafone jumped 8.2 per cent after saying it was in talks with Verizon to sell its 45 per cent stake in their US joint venture Verizon Wireless, for what a Bloomberg report said would be about $130bn.

“Base case assumptions here remain that Vodafone stock trades around 220p-225p on a firm announced deal, so it gives some 15p of upside from current levels,” Simon Maughan, analyst at Olivetree Financial Group said.

Vodafone’s share price surge represented a rise of around £8bn in the market capitalisation of the group, which is the fourth biggest UK company by market value after Royal Dutch Shell, HSBC and BHP Billiton.

The news sparked a rally in the sector, with Telecom Italia up 0.7 per cent, Orange up 1.7 per cent and Deutsche Telekom rising 1.3 per cent. The STOXX Europe 600 telecom sector index gained 3.3 per cent.

“Bulls will have taken heart from the resilience of the FTSE in bouncing back above 6400, and today’s FTSE action has very much been Vodafone driven,” said Alastair McCaig, market analyst at IG.

The prospect of military action in Syria has taken its toll on market sentiment in the past few days, fuelling worries about Middle Eastern crude supply.

But investors were more open to buying yesterday as prospects of an imminent Western-led attack on Syria lessened, and as some started to take the view that any military intervention would be unlikely to have a huge impact on the global economy.

Data showed the US economy grew at a faster pace than expected in the second quarter.

This caused the index to pare back its gains as stronger US economic growth could encourage the US Federal Reserve to scale back stimulus more quickly, but it later recovered its upward momentum.

“If the markets do go down on the back of Fed tapering fears or now on this Syria thing I’d be stepping in and buying,” Paul Jackson, strategist at Societe Generale, said.

Jackson reckoned that while there will be a period of market uncertainty when the Fed starts to scale back its stimulus, this will prove short-lived, and that even if there is military intervention in Syria, it will be a “storm in a teacup”.

“You may get Brent going up to $125 which I don’t think is enough for me to change my view on the world,” he added.