Corporation tax collected via HMRC probes falls to six year low

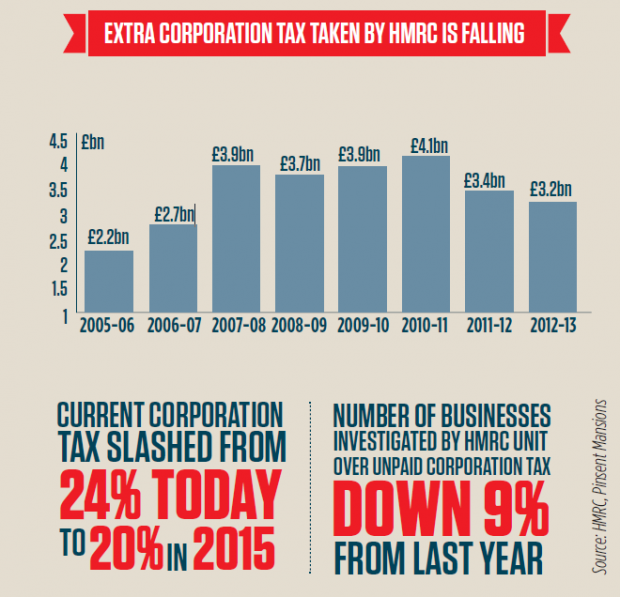

EXTRA corporation tax collected through HMRC investigations fell to a six year low last year, fresh figures released today show.

The fall in corporation tax collected by HMRC’s large business division, which handles FTSE 350 companies, is due to a lower rate of tax and less aggressive tax planning by corporates.

The large business division, which examines tax returns sent in by over 700 large UK firms, opened 405 investigations last year, down slightly on the 444 opened in the previous year. In total cash obtained via tax investigations fell to £3.2bn for 2012-13, the lowest level since 2006-07, according to figures from Pinsent Masons.

The company’s head of tax Jason Collins said: “It is frequently argued that lower taxes and simpler taxes should lead to lower levels of tax evasion and avoidance activity and inevitably that means lower tax investigation yields.”

HMRC collects the extra tax revenue after examining self-assessment returns submitted by firms and enforcing the correct amount