Verizon plans bond to finance Vodafone deal

VERIZON could begin marketing the sale of up to $25bn (£16bn) in new bonds this week as part of its efforts to finance the purchase of Vodafone’s stake in Verizon Wireless.

Verizon last week agreed to buy Vodafone’s 45 per cent stake in Verizon Wireless for $130bn, half of which will be financed by $61bn in short term loans from four US banks.

Verizon is thought to be planning to replace these loans with longer term loans and bonds with up to 100-year maturities to US fixed income investors.

Meanwhile, a Verizon shareholder is attempting to derail the Vodafone deal after filing court documents last week to have the deal blocked.

Natalie Gordon filed a lawsuit with New York state Supreme Court on Friday, alleging Verizon overpaid for Vodafone’s stake and calling on the judge to block the sale until shareholders, “obtain a merger agreement providing fair terms”.

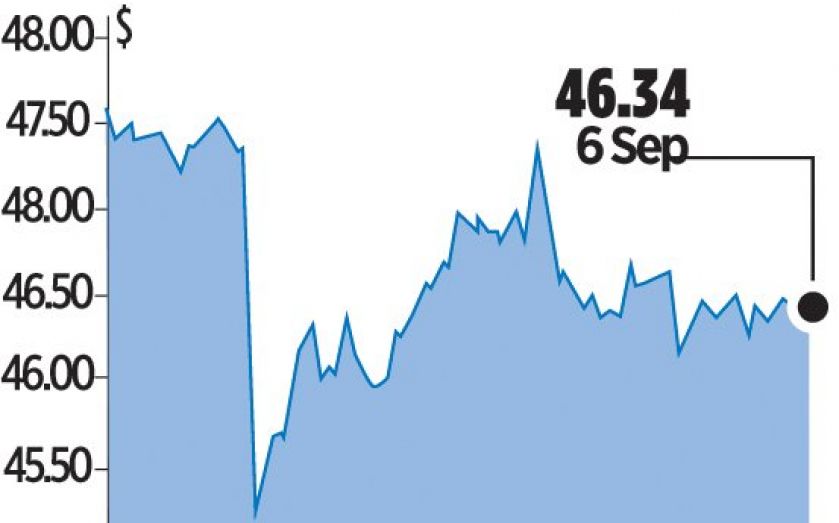

In her filing Gordon points to Verizon’s falling share price over the past week as evidence of overpayment, before the deal was announced Verizon was trading at $48.60 before plummeting to $45.08 the day the deal was announced, a fall of 7.2 per cent.

Gordon, a serial litigator with cases against Netflix and Microsoft, names Verizon’s chief executive and 12 directors as defendants.

“We believe this lawsuit is entirely without merit,” Randal Milch, Verizon vice president and general counsel, said.