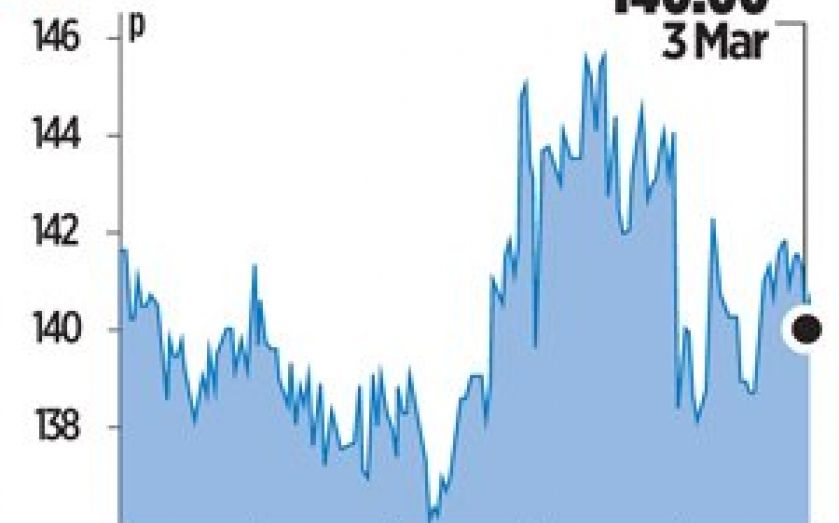

Premier close to securing £350m rights issue plan

PREMIER FOODS is set to announce a radical financial restructuring as soon as this week as part of chief executive Gavin Darby’s rescue plan to turn the debt-laden group back into a “normal company” again.

The company behind Mr Kipling cakes and Bisto gravy is expected to launch a £300m-£350m rights issue and is also working on a £400m bond issue to slash its debt, which stood at £890m in June.

A syndicate of more than 20 banks currently own a slice of Premier’s debt and by refinancing the company hopes to shrink this to a core of around five.

Premier also hopes to tackle its £395m pension deficit by striking a deal with pension trustees to reduce its contributions in the short term.

Ondra Partners, HSBC and corporate brokers Jefferies and Credit Suisse are advising Premier, which is expected to announce plans with its full-year results.