Banks’ UK focus pays off as the recovery begins

THE RECOVERY in the UK and the slowdown in emerging markets mean banks focusing on Britain offer increasingly good value to investors, a top analyst said yesterday.

Global economic trends are starting to feed through to individual firms, said JP Morgan’s Kian Abouhossein, marking a significant turnaround for a sector which has suffered in the UK since the credit crunch.

Improving capital levels in Britain over the past years have also made the sector more stable, and the drag on profits is also nearing an end.

“With an improving economic outlook for the UK and substantial progress on capital made by domestic UK banks in 2013, we believe that the relative attractions of the domestic UK banks sector have improved compared to HSBC and Standard Chartered, which face headwinds within some emerging market economies,” said Abouhossein in a note to investors.

“In our view, an increase in emerging markets provisions remains the key risk for both banks over the next 12 months given their premium valuation relative to other UK and European banks.”

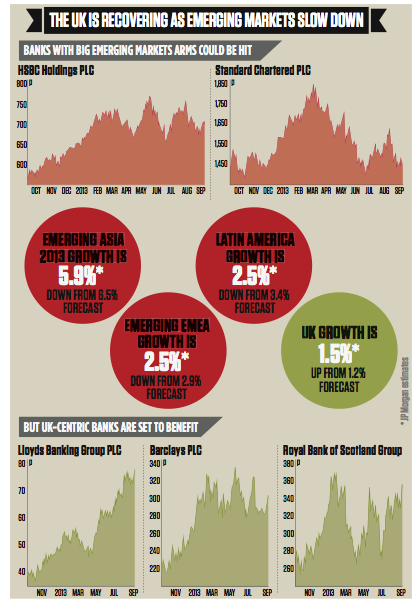

The investment bank’s economists have cut their 2013 GDP forecasts for emerging Asian economies from 6.5 per cent at the start of the year to 5.9 per cent now.

Their emerging Europe, Middle East and Africa (EMEA) forecast is down from 2.9 per cent to 2.5 per cent, and they believe Latin American economies will grow at 2.5 per cent, down from 3.4 per cent.

But they have hiked their UK forecast from 1.2 per cent earlier this year to 1.5 per cent now.

Abouhossein also believes Lloyds is increasingly strong: “Lloyds is likely to end up as the best capitalised UK bank on our estimates, with Basel 3 core equity tier one capital of 13 per cent by the end of 2015 which may create an option for capital return through buybacks in addition to a normalising dividend policy,” he said.