Rise in new jobs casts doubt on Bank rates plan

STRONG figures released by the Office for National Statistics yesterday showed a significant drop in unemployment, casting doubt on the Bank of England’s new policy on rates.

The rate of joblessness has become even more important since Bank of England governor Mark Carney revealed his forward guidance plan in August, announcing that current historically low interest rates will not be altered until unemployment dips below seven per cent.

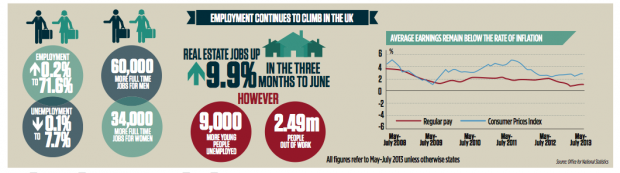

Over the three months to July, the employment rate rose to 76.4 per cent, and unemployment dipped, down to 7.7 per cent, a 0.1 per cent fall from April, and 0.4 percentage points lower than one year ago.

The number of people out of work and looking fell to 2.49m, and the number of people actually claiming unemployment benefits fell to 1.4m, the lowest in four and a half years.

The most marked change between May and July wasoverwhelmingly in full-time employment. For women, there were 34,000 new full time and 5,000 new part time jobs. For men, the number of part-time jobs actually fell, in contrast to a 60,000 boost to full time employment. The total number of hours worked every week is climbing back towards pre-crisis levels, up to 958.2m between May and July, up by more than 20m hours from a year ago.

As the housing market bounces back, there has also been a rise in jobs in real estate, with 77,000 more positions making up more than a fifth of the total added. Despite the boost, total pay only rose by 1.1 per cent compared to the same period in 2012, way below inflation.

•BANK of England policymaker David Miles yesterday defended the central bank’s guidance on interest rates saying the recent rise of borrowing costs in financial markets was due to the UK’s strengthening economy.

- Pound soars to 8-month high on jobs figures

- Stalled productivity poses threats to public services

- Real estate jobs boom a worry – but labour market rebalancing