How to exploit global export opportunities with careful planning

Liam Ward-Proud looks at three vital points for startups that are planning to sell abroad

ECONOMISTS at RBS have just released research into the attractiveness of foreign markets, concluding that “there are export opportunities around the globe that British businesses aren’t fully taking advantage of.” This comes little more than a week after the ONS revealed that the UK’s trade deficit rose to £3.085bn in July, from June’s £1.256bn. With exports set to play a vital role in the UK’s economic recovery, here are some key points to consider when thinking about going global with a startup.

CHOOSING THE MARKET

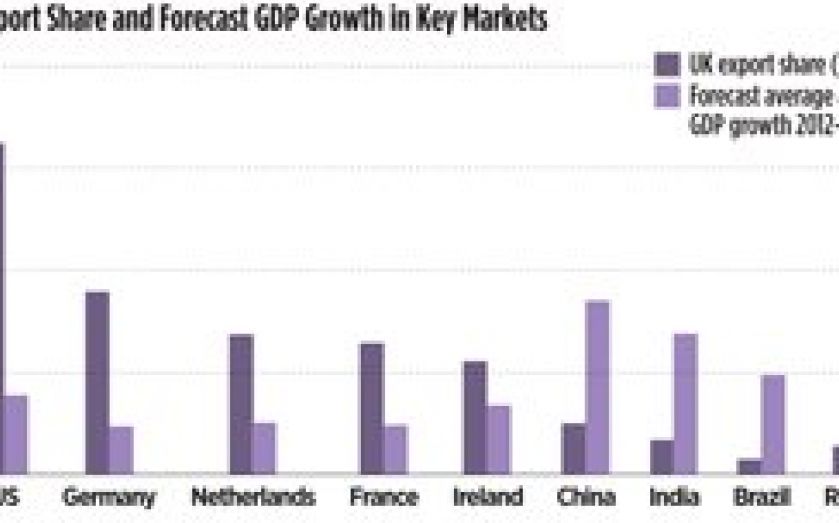

The US and EU have traditionally been the primary regions of choice for UK exporters, but this may be set to change as rates of growth in emerging markets outstrip those of developed economies (see graph below). RBS economists have created an index of attractiveness for foreign markets, ranking them from 0 (no match as a trading partner) to 1 (perfect match). Brazil came out with a compatibility score of 0.62, very close to the US’s 0.65, despite the fact that the UK exports far more to the US than the latter. “Around 41 per cent of Brazil’s imports are things that the UK exports heavily,” the report says, a signal of clear opportunities for UK firms. The research finds that Mexico, Taiwan and Turkey have similar benefits on offer.

“We think we’ve unearthed some hidden gems,” RBS’s David Fenton says. But he points out that individual businesses should pay more attention to the different market characteristics according to the goods or services they plan on selling. “A luxury goods vendor, for example, would want to look more closely at the prosperity metric,” he says. An exporter of widely-used goods, by contrast, should pay more attention to the ease of exporting, including tariffs and customs procedures. On this metric, Singapore, Qatar and Hong Kong excel in the RBS research.

FOREIGN EXCHANGE RISK

According to Gary Steadman of Axia, “businesses that don’t hedge against currency fluctuations could see their margins drastically cut.” This is particularly the case with small businesses. “We work with startups in the early stage when margins are as low as 2 per cent. A sharp currency movement could mean the difference between profit and loss for these companies.”

Forex markets have been particularly volatile of late, meaning that employing the services of a forex broker or a bank is more important than ever. But Moneycorp’s Chris Redfern says that hedging against fluctuations does not only protect margins. “It allows you to forget about currency risk and focus on building the product. Startups have plenty to worry about aside from forex markets.”

LOCAL REGULATIONS

According to Mike Josypenko of the Institute of Exports, “there are a host of individual regulations governing imports of goods around the world that small businesses should be aware of.” Standard checks, such as whether your buyer has an import licence, and who is liable to pay customs tariffs (usually the buyer, but not always), are essential worldwide. “But it is always worth seeking advice from bodies such as the Institute of Exports and UK Trade and Investment about the specifics of different countries,” he says.

Josypenko points out that Australia, for example, has very specific regulations around the importation of wood products, including packaging materials, because of the risk of introducing foreign organisms that may upset the ecosystem. Gems and chemicals are also subject to different regulations globally.