How to invest in a new dawn for UK privatisation

But Lloyds and Royal Mail may not match past successes, writes Liam Ward-Proud

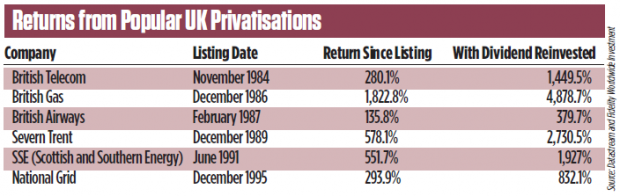

AN AUTUMN of privatisation is underway. This week, the government sold a 6 per cent stake in Lloyds to institutional investors, with plans to extend the sale to the public currently under consideration. At a price of 75p a share, the sale raised £3.2bn and was 2.8 times covered by investor demand. Royal Mail, meanwhile, will be floated in mid-October. The public will be able to apply for a minimum of £750 worth of shares per person, with £133m set aside for dividends in July 2014. Recent research from Fidelity showed that previous UK privatisations, particularly those paying generous dividends, have been excellent long-term investments (see table). But will Lloyds and Royal Mail prove similarly lucrative?

“Lloyds is basically a bet on the UK economy,” says Richard Hunter of Hargreaves Lansdown. As the recovery continues, domestic-focused banks such as Lloyds are likely to benefit. And Danny Cox, also of Hargreaves Lansdown, notes that “shares have already risen by 12 per cent since the announcement of the sale.” With the bank posting profits of £2.1bn in the six months to June, many expect this trend to continue. “While Lloyds shares are obviously available already, the exit of government as a major stakeholder is likely to boost returns,” says Hunter.

Fidelity’s Tom Stevenson is similarly positive on Royal Mail. “It’s a good way to play the growth of internet shopping,” he says. Revenues from parcel delivery were up 13 per cent in its most recent annual results, with the service now accounting for 48 per cent of revenue. According to Hunter, the parcel delivery market is highly competitive, “but Royal Mail also has the chance to realise serious efficiency gains when it moves into the private sector.” “In very general terms,” says Gavin Oldham of The Share Centre (an intermediary for the sale), “companies that move from government to private hands have room to grow.” Stevenson says that there are risks around the workforce, with strikes planned in reaction to the privatisation, “but these factors will likely be priced in to the float, which we expect to be an attractive level.”

Retail investors can apply to buy shares directly from Royal Mail, or through brokers such as Hargreaves Lansdown and The Share Centre. Stevenson recommends that anyone with room left in an Isa allowance should add the shares to this or any other tax wrapper they have.

Despite the high expectations of many analysts, Paul Taylor of McCarthy Taylor is wary of Royal Mail. “This is very different to previous large privatisations,” he says. “Where BT and British Gas had near-monopolies, Royal Mail is entering a cut-throat environment.” Deutsche Post, the German equivalent, was floated in 2000 for around the €23 (£19.31) per share mark. Today, Taylor points out, it is at almost exactly the same level.

“It all comes down to the initial price,” he says. “Having transferred around £40bn of pensions liabilities to the public purse, the government will not want to appear to be missing an opportunity by selling it cheap to private investors.”