If US tapering happens today markets have been proved right yet again

Fans of liberal economics will often say the market is a fantastic co-ordinator of activity, and as an aggregator of information, is really good at predicting future events.

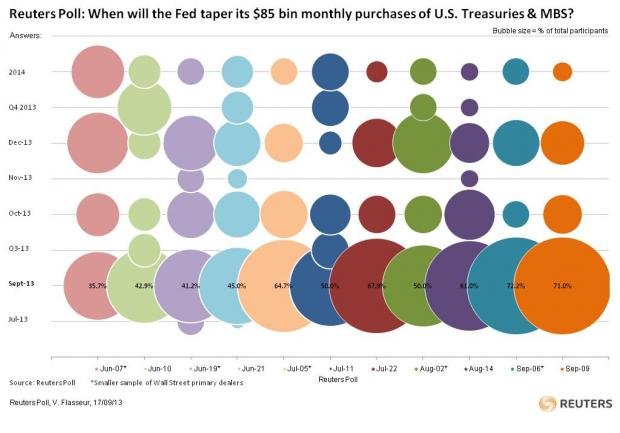

The start of US Federal Reserve tapering has been "priced in" for September 2013 for a while now. That is, traders have expected this month as the one when tapering will begin, and prices have been reflecting that.

Need more proof? This graph is pretty definitive:

Lars Christensen, chief analyst, Danske Bank:

No individual, however intelligent, can know enough about the economy to make a really reliable prediction about it.

And it’s not just the dragging-together of information from thousands of different sources that makes market predictions more accurate than those made by small elite groups. Investors betting in markets have skin in the game; they have an extremely strong incentive to get their bets right, since they will lose money for bad (inaccurate) bets and win money for good (accurate) ones.

In a recent working paper for the National Bureau of Economic Research, for example, John Bullock, Alan Gerber, Seth Hill and Gregory Huber detailed an experiment they carried out in which two groups were asked basic factual questions about politics – but one group was given a chance to win Amazon vouchers if they answered questions correctly. In the control group, where they were just asked questions, there was a wide partisan gulf in the accuracy of answers. But when subjects had skin in the game, the gap was 80 per cent smaller. Without a prize, talk was cheap, but the chance of winning something made subjects think more clearly.