Sports Direct’s chairman in line for £67m bonus

SPORTS Direct announced plans yesterday to introduce a bonus scheme that could award Mike Ashley a windfall of £67m, nearly two years after shareholders rejected previous plans to reward the retailer’s founder.

The sporting goods retailer has called for a shareholder meeting on 4 April to vote on whether to award Ashley 8m shares, which at yesterday’s closing price were worth £67m.

Ashley, who owns a 62 per cent stake in Sports Direct and acts as its executive deputy chairman, receives no salary or other bonus, despite having founded the retailer and played a key part in its growth into a £6bn business empire.

The shares will vest in July 2018 if the firm hits its earnings before interest, tax, depreciation and amortisation (Ebitda) of £330m this year and £410m for 2015, as well as a net debt/Ebitda ratio of 1.5 times or less at the end of its 2015 fiscal year.

The targets for Ashley are tougher than those set for the employee bonus scheme, which requires Sports Direct to hit full-year Ebitda of £310m and £360m for 2014 and 2015 respectively.

Sports Direct said it has already received support from its largest institutional shareholder, Odey Asset Management, which has confirmed that it intends to vote in favour of the resolution next month.

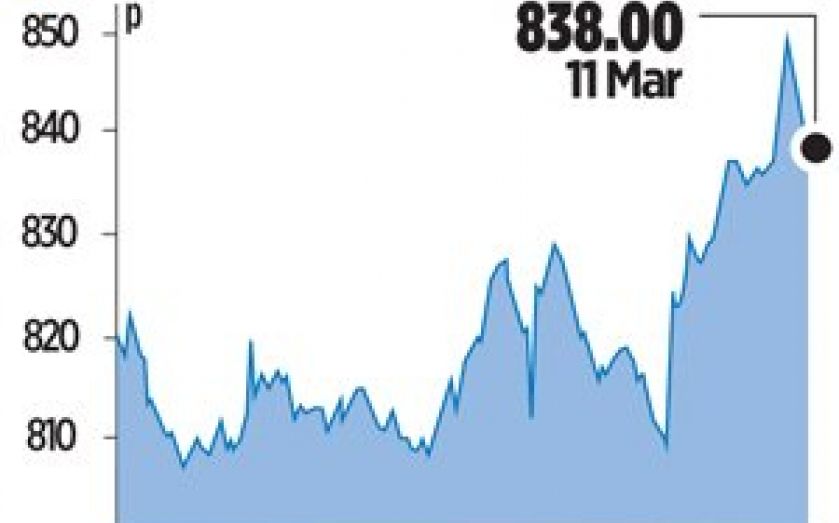

The retailer withdrew a similar scheme in 2012 after proxy votes at the time indicated it had failed to win enough shareholder support to push the motion through. Shares rose 3.59 per cent last night to 838p.

THREE KEY NUMBERS THAT SPORTS DIRECT INVESTORS SHOULD KNOW

1 62 per cent

The stake that Mike Ashley holds in the firm he founded in 1982

2 838p

Yesterday’s closing price of Sports Direct shares – 88 per cent higher than a year ago

3 4 April

The day that shareholders will vote on Ashley’s proposed

share bonus award