Copper prices are getting slammed. Here’s what you need to know

Copper values are down for a fifth straight day, as global economic worries see the red metal trade near its lowest level since July 2010.

Societe Generale's Kit Juckes identifies tensions in Ukraine and ongoing Chinese growth fears as responsible for the downturn in prices.

This weekend saw Chinese exports sharply lower, and a potential slowdown in the country could severely dent demand for the metal. In China the metal has been popular for its application as collateral on loans, but that use may be falling out of favour.

Today rumours that a Chinese solar company would announce a default have seen further copper weakness. While those rumours are unconfirmed, IronFX Global's Marshall Gittler says that it has seen a rout in commodities, with oil prices also affected.

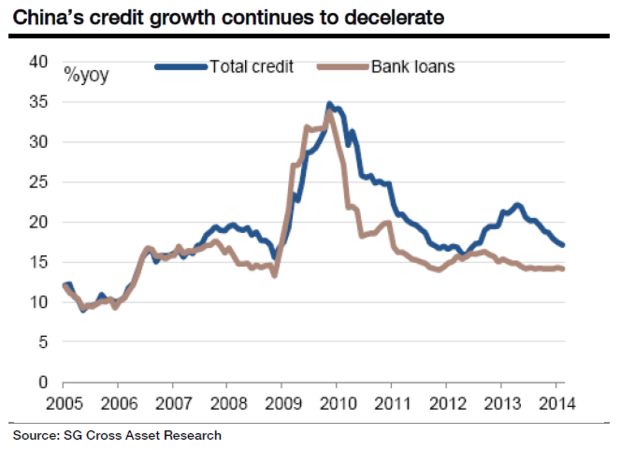

Gittler expects tensions in Ukraine "will only increase" as a key referendum approaches, while the "unravelling of the Chinese credit bubble is just getting started."

There is some joy for gold investors however, as traders move into safe-haven assets such as the precious metal and core government bonds.

Gold is up by more than 0.7 per cent at around $1,356/oz.