GlaxoSmithKline sells thrombosis drug brands to Aspen for £700m

BRITAIN’S biggest drugmaker GlaxoSmithKline has agreed the £700m sale of its thrombosis drug brands and a related factory to Aspen Pharmacare, as part of its strategy to focus on growth products.

The company said yesterday the divestment to South Africa’s biggest generic drug maker would earn it proceeds of £600m and £100m of the headline price related to inventory.

The disposal, which was flagged by GSK in June, involves the Arixtra and Fraxiparine brands, whose worldwide sales are in decline and would otherwise have dragged on GSK’s growth at a time when new drugs are set to reach the market.

GSK said that it would retain the rights to the thrombosis brands in China, India and Pakistan.

GSK, which owns an 18.6 per cent stake in Aspen, said that the sale proceeds would be used for general corporate purposes.

Earlier in September, GSK also sold its Lucozade and Ribena drink brands for £1.35bn to Japan’s Suntory Beverage & Food.

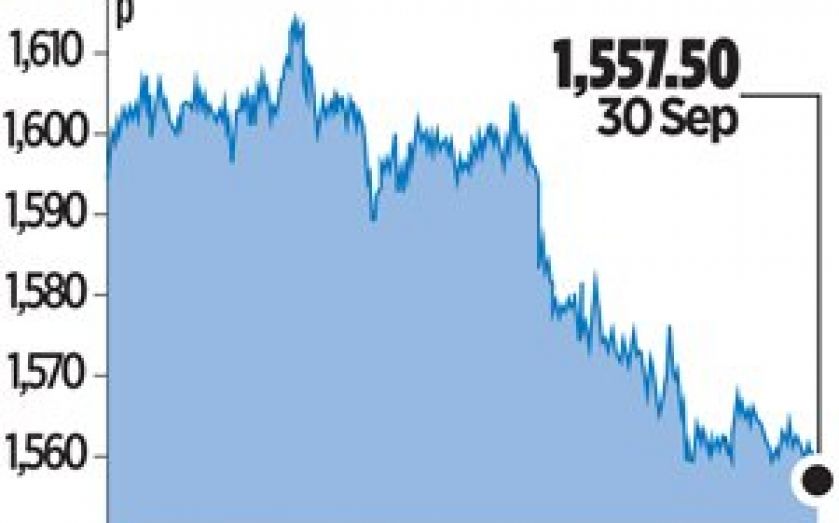

Shares in GSK fell slightly to close 0.7 per cent down at 1,557.5p, in line with the overall drop in the FTSE 100.