Shares in bookies crash as Osborne hikes taxes on betting machines

Some of Britain's leading bookmakers are taking a beating after George Osborne announced that the tax on fixed odds betting terminals (FOBTs) would be raised from 20 per cent to 25 per cent.

Shares in Ladbrokes have crashed by 12 per cent while William has suffered a decline of six per cent.

Investec specialist bank have calculated that on an annualised basis William Hill could take a hit of £23.8m and Ladbrokes would be negatively impacted to the tune of £21.9m

In January, JP Morgan warned that a fifth of Britain's betting shops could become unprofitable if further regulations are imposed on the gambling industry.

A further 20 per cent of shops could become only marginally profitable if measures such as limits to the number fixed odds betting terminals (FOBTs) and the size of prizes are introduced.

FOBTs have become a popular target for politicians, with Ed Miliband labelling them "dangerously addictive."

Speaking in December Ed Miliband said:

In the poorest areas, these are spreading like an epidemic along high streets with the pawn shops and pay day lenders that are becoming symbols of Britain's cost-of-living crisis.

A host of charities, faith organisations and anti-gambling groups have attacked FOBTs as the "crack cocaine of gambling."

However, there is little evidence to the support the claims that FOBTs are having the devastating impact attributed to them by campaigners.

According to the Institute of Economic Affairs, £42bn is put into FOBTs each year. However, 97 per cent of this figure is returned in prizes. The £1.5bn per year lost through FOBTs is equivalent to the amount lost through over the counter betting.

The number of betting shops in the UK has also not risen dramatically. From 2000 to 2012 the number of bookies rose by just 4.5 per cent, after falling to an all-time-low at the turn of the century.

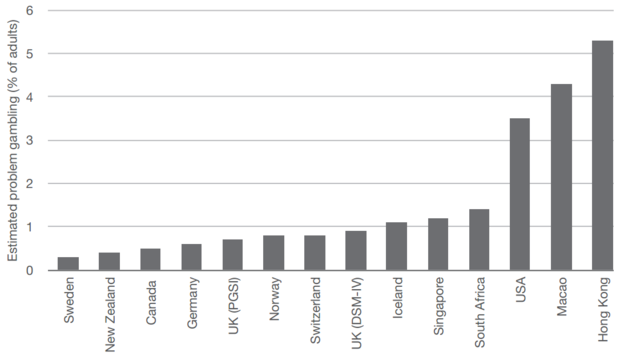

Britain also has a relatively low prevalence of problem gambling compared to other countries.