Recovery boosts confidence and profits in City

FINANCE firms are doing increasing amounts of business with each other as confidence in their strength and in the economic recovery sets in, according to a report out today from PwC and the Confederation of British Industry (CBI).

Optimism in the sector over the last quarter rose at the fastest rate since 1996, with upbeat firms outnumbering pessimists by a margin 53 per cent, the survey found.

A net balance of 24 per cent said they have increased their headcount in the last quarter, while a balance of 14 per cent expect to hire more in the coming three months.

Meanwhile the study found a balance of 37 per cent of firms reporting a rise in average spreads, pushing up incomes – a balance of 26 per cent reported improved profitability.

“Firms are expecting positive momentum to carry into the next three months, alongside a strong recovery in business volumes, which will boost profits further,” said the CBI’s Stephen Gifford. “Financial services companies are less worried than they were about a potential lack of demand, but dealing with regulation is increasingly weighing on plans for business expansion.”

Some areas of work struggled, as a balance of 18 per cent reported falling business volumes with industrial and commercial companies, and the same level saw sales overseas drop in the quarter.

That compares with strong growth in sales to financial institutions and a tiny rise in sales to individuals.

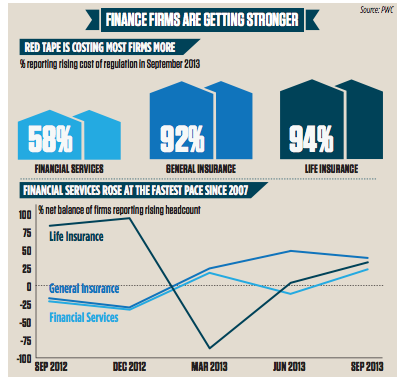

And although employment increased, much of the hiring was driven by the rising tide of regulation increasing the need for risk and compliance staff.

An overwhelming net balance of 83 per cent of firms expect to spend more on compliance in the next quarter. That rises to 99 per cent among banks.

The worries are putting the dampeners on growth even as the economy improves, PwC warned.

“Regulation continues to be the sector’s greatest source of uncertainty, particularly as UK macroeconomic concerns start to fall away,” said Kevin Burrows.