Cable insists that Royal Mail price is right

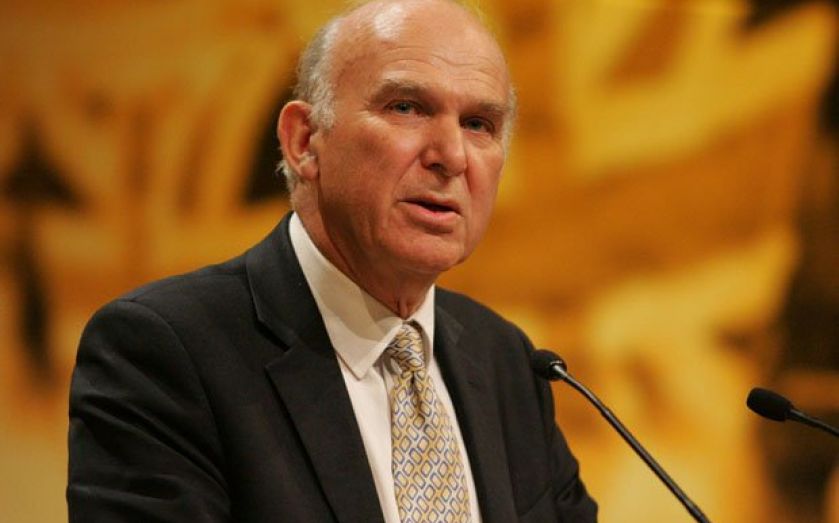

BUSINESS secretary Vince Cable last night accused Labour’s Chuka Umunna of irresponsibly stoking demand for shares in Royal Mail, after the shadow business secretary suggested the group was being privatised too cheaply and has £1bn in property assets that could be sold.

“I feel it is irresponsible to imply that a share offering looks significantly undervalued,” Cable said in a letter. “I think you should consider the risk that you may be influencing the decisions of retail investors.”

According to the most recent grey market valuations, Royal Mail stock is set to jump by a fifth on the firm’s first of trading, with a huge number of retail investors seeking to buy shares ahead of the deadline to apply tonight.

Stockbrokers are staying open until midnight to deal with a last-minute rush of applications for shares, with the stock set to price at the upper end of a 300-330p price range later this week.

But spread betting firm IG said its punters are currently expecting a first day close of 406p, meaning they expect the business to be worth £4bn by Friday.

IG, which runs a pre-offering grey market in the stock, said trading was the strongest it had seen since before the flotation of Lastminute.com in 2000.

Shares will begin conditional trading on Friday, with full trading – when retail investors can start to sell shares – next Tuesday.

- How to buy shares in Royal Mail

- With price estimates between 300 and 330p per share, are Royal Mail stocks undervalued?