Copper decline crushes profits at Antofagasta

MINING giant Antofagasta saw its shares slump yesterday, after it revealed its profits had taken a big hit in the first half, with the lower price of copper and higher costs damaging its bottom line.

Pre-tax profits during the six months to 30 June were $850.7m (£512.8m), down 13.3 per cent on $981 over the same period in 2013, with revenues at $2.66bn in the first half of 2014, down 4.4 per cent on $2.78bn last year.

The FTSE 100 company, with significant operations in Chile, was hit by a 2.2 per cent drop in the sale price of its copper, its main focus, with total sales volume in the commodity rising only 0.6 per cent during the period, on production down 4.4 per cent.

Rob Broke, analyst at Westhouse Securities, said: “Antofagasta’s first half results were broadly in line with consensus, but we still see little room for optimism over the short term with a lack of near-term growth.”

Diego Hernandez, chief executive of Antofagasta Minerals, said they operated in a “challenging market”, but added: “We believe that the market fundamentals for copper are strong. Despite recent increases in new mine supply from various projects coming on-stream, the market remains balanced, contrary to expectations earlier in the year that a supply surplus would emerge.”

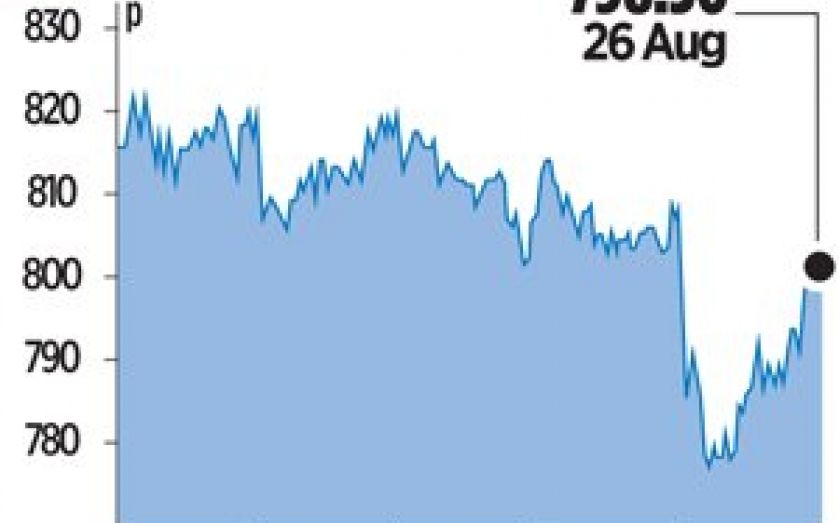

Shares fell 1.2 per cent to 798.50p.

Antofagasta’s share price fell … per cent yesterday, to finish on …