Struggling RSA sets out £773m share issue plan

TROUBLED insurer RSA has announced plans for a £773m share issue to tackle major losses.

The company, which hired ex-RBS boss Stephen Hester in February this year, said the rights issue will help it to shore up its capital position, after expensive weather-related claims and a £200m black hole was discovered in its Irish business.

The insurer will offer shareholders three new shares at 56p each for every eight existing. The plan is fully underwritten by both Bank of America Merrill Lynch and JP Morgan Cazenove, who will pay out even if shareholders do not take up the offer. The insurer is being advised by lawyers Slaughter and May, who expect £748m to be raised by the share issue, taking into account £25m in costs.

“The rights issue will enable the group to restore its capital position and keep ahead of anticipated industry capital trends, and that this will allow the business to carry out its action and improvement plans without undue risk of suboptimal decisions forced by capital shortage or instability,” Hester said yesterday.

RSA set out plans in February this year to raise £1.6bn in capital, partly from the shares issue and the rest from asset disposal. The shares offered in this deal represent a 40 per cent discount to shareholders compared to Monday’s closing price, which analysts believe will generate enough cash for the struggling company.

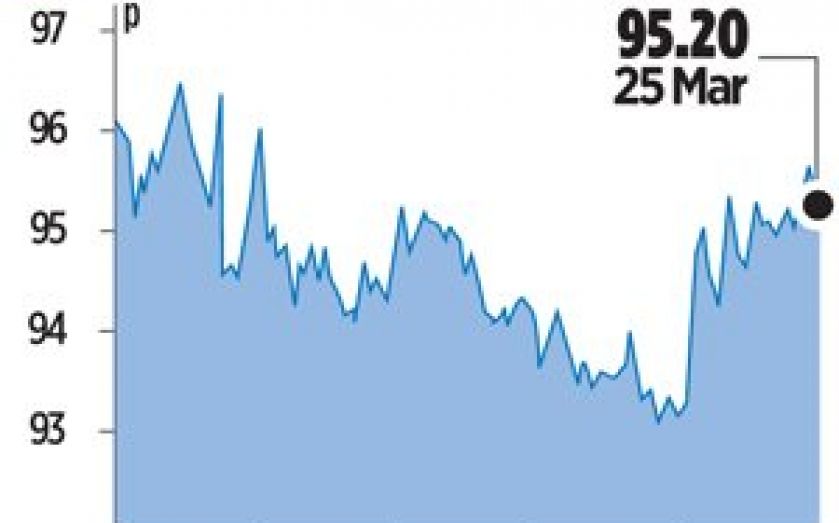

On news of the announcement yesterday shares in RSA rose from an opening price of 93.8p per share to a close of 95.15p, up nearly two per cent.

CRUNCHING THE NUMBERS ON INSURER RSA

£338m

The loss after tax RSA made last year after being hit by weather and Irish business losses

£773m

RSA hopes to raise £773m from a share issue to plug holes in its balance sheet

£2.85m

New CEO Stephen Hester is to get three times his salary, or £2.85m, in payments this year