BSkyB faces “significant risks” over Premier League auction

HSBC has reiterated its bearish position on BSkyB with an "underweight" rating.

The bank expects concerns over the Premier League rights auction will resurface resulting in significant risks to BSkyB.

Despite a rise of 8.2 per cent in BSkyB's share price since the beginning of 2014 HSBC believe that once the bidding begins for the rights, the focus will return to the risks of a step-up in competitive intensity.

This would in turn have implications for the company's cost base.

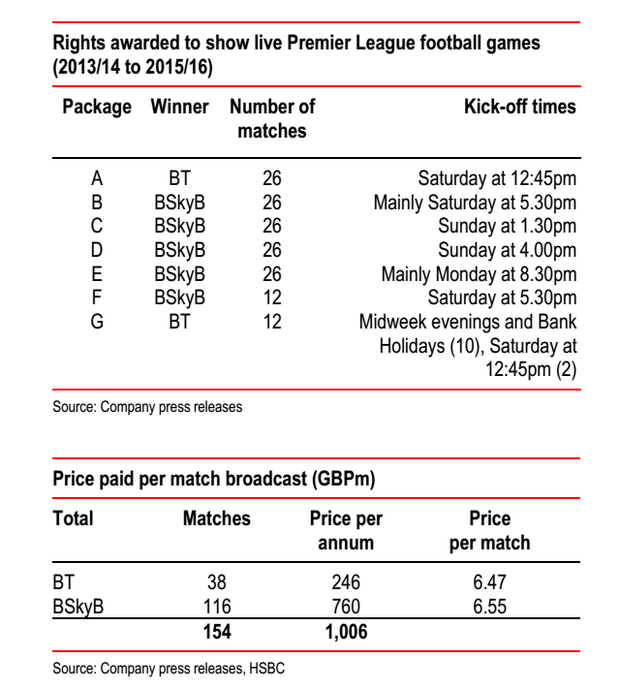

The auction for Premier League football rights could start with the 2016/17 season, according to the Daily Telegraph. HSBC's scepticism starts from the position that Premier League is a commercial organisation seeking to maximise the value of the rights, which are auctioned every three years.

The bank does not believe that the "no single buyer" clause will be withdrawn. With BT likely to continue its sports channel HSBC think it is likely to be the winner in a contest for the rights. The company cites BT's significant investment to date as part of their reasoning.

BSkyB could consequently suffer "significant rights inflation" or a "weakened relative position." Two scenarios are outlined in the research note. The first being a broadly even split in matches between BT and BSkyB leading to significant cost inflation, with HSBC estimating 35 per cent.

The second scenario is that is that BT manages to achieve a greater share of the rights, with Sky suffering as a result. The note also refers to HSBC's low-end triple-play bundle NOW, and find that that unsurprisingly for a pay-TV incumbent, the new bundles ward off potential threats rather than targeting the pay-TV-lite segment.

The note concludes:

Our longstanding bearish position on BSkyB remains, based upon: i) content cost inflation; and ii) the disaggregation of the premium bundle as consumers gain options to purchase over-the-top services.