More mining M&A on the cards? Anglo American share price rises as boss says “come and get us”

Shares in Anglo American, the world's largest platinum miner, jumped 2.6 per cent this afternoon after its chief executive said the company is open to takeover offers.

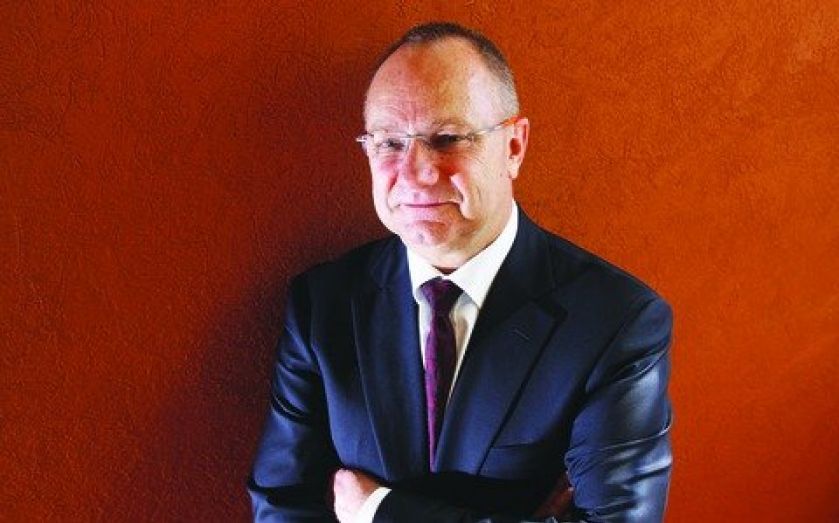

In an interview, Mark Cutifani said his job is "to create value" – adding that "if somebody sees value, then there's a conversation to be had".

I'm not anti. I'm very open. I'm not scared by it.

A takeover would be a drastic departure from the strategy of former chief executive Cynthia Carroll, who stepped down in February last year. In 2009 she rebuffed an approach from Xstrata (which has since itself merged with Glencore).

Like rivals including BHP Billiton, which last month spun off dozens of assets into a new company in order to focus on higher-margin businesses, Anglo has said it will sell some of its assets, including older, deep-level platinum mines.

According to the Wall Street Journal, in which the interview appeared, Cutifani is targeting return on capital employed of at least 15 per cent by 2016, from 10 per cent in the first half of this year. "It is an imperative we have to get to. We've got to be doing better than that number," he said.

But by all accounts, it will be a long, hard slog. Although shares are up 17.5 per cent this year, the company reported in July that quarterly platinum production had dropped 40 per cent after a five-month strike at one of its mines in South Africa.