UK house prices surge to above 2008 levels

(Office for National Statistics)

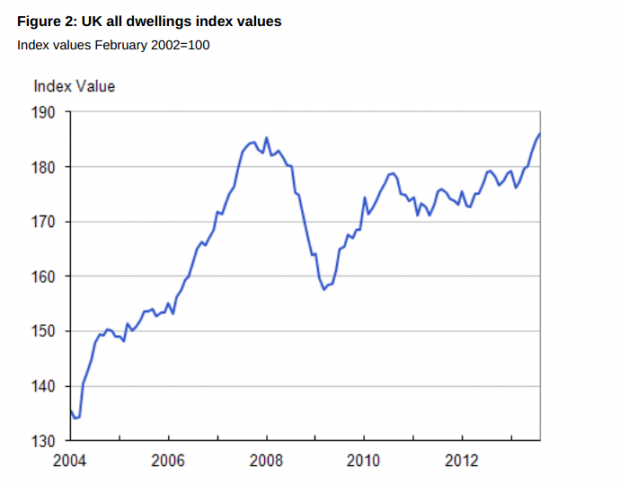

UK house prices rose by 3.8 per cent in the year to August, exceeding expectations of a 3.6 per cent increase and surpassing its previous peak in January 2008 by 0.3 per cent.

The Office for National Statistics reports that house price growth remains stable across the UK, with London prices going up faster than the country's average. This is the fastest growth rate seen since October 2010.

The capital saw an 8.7 per cent increase, with 3.8 per cent price increase in the East Midlands and 3.5 per cent in the West Midlands.

Howard Archer, chief UK and European economist at IHS Global Insight, says that "while the strength of house price rises in London is becoming an increasing concern and pushing up the overall national increase in house prices, the ONS data support the view that we are currently a long way off from an overall housing market bubble emerging." He points out that, in many areas, house prices are still well below their 2007 peak levels and are currently rising only modestly.

Excluding London and the South East, UK house prices increased by 2.1 per cent in the year to August, which Rob Harbron of the Centre for Economics and Business Research says suggests that some strength is returning around the country. With London and the South East factored in, the increase was 2.2 per cent. However, with London excluded, house prices overall were still 4.0 per cent below their January 2008 level in August. Interestingly, London and the South East, along with Northern Ireland, were the only areas to see marginal slowdown in August.

Archer comments, "An improving housing market is supportive to economic activity and growth prospects, while modest house price rises also have some benefits, especially when they are occurring in areas where house prices are still substantially below their peak 2007 levels and a significant number of people are facing negative equity." He adds that "it is vitally important for economic stability and longer-term growth prospects that a new housing price bubble does not emerge."

Berenberg's chief UK economist Robert Wood says this improvement in the housing market "is driven by BoE and government schemes to lower the cost of credit… Rapidly rising house prices are more likely to be a problem for forward guidance than rising consumer prices. We expect prices to rise 10% year-on-year next year."

Nicholas Ayre, managing director of home buying agency Home Fusion says on London's growth:

Supply constraints are such that if Help to Buy really did take off then a housing bubble might be possible. If more flats and houses are not built, a significant spike in mortgage transactions could substantially push up house prices. But we are nowhere near that just yet. While the recovery in property prices in London continues apace, this is far from the case throughout the UK. It is also worth remembering that transaction levels remain very low compared with what they were at the height of the housing boom.

London continues to be a special case that almost needs its own house-price index, with no sign of a slowdown in price rises in the capital.