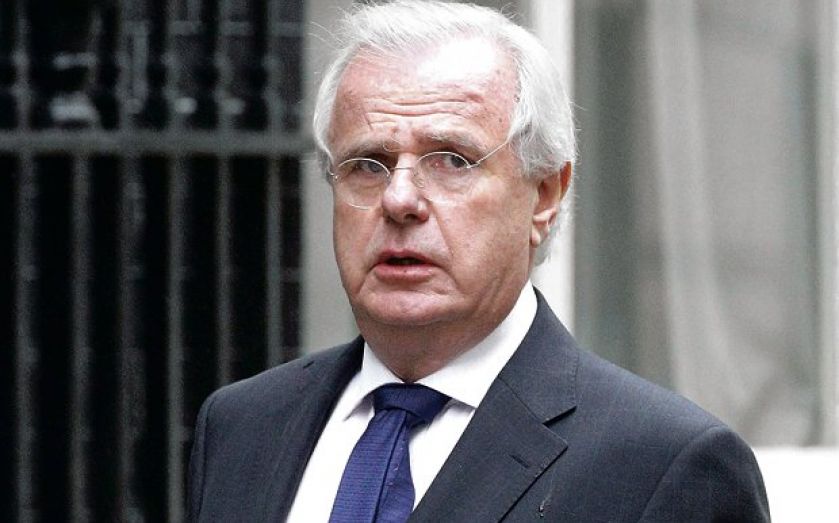

Co-op in turmoil as Myners quits

THE CO-OPERATIVE Group was plunged into fresh chaos last night after the man tasked with saving the troubled organisation quit the group.

Lord Myners, a former City minister, is set to resign his post as senior independent director just four months after he was appointed to lead an overhaul of the company’s bloated structure.

It leaves the historic organisation in further disarray, amid ongoing problems at its banking arm.

Myners will leave the organisation, which operates supermarkets to funeral homes, after he completes a report into leadership failures at the business, commissioned after a £1.5bn blackhole was discovered at the Co-op Bank last year.

The exit comes a month after former chief executive Euan Sutherland was also forced out over plans to alter the make-up of the Co-op boardroom. He later branded the Co-op “ungovernable”.

Myners’ decision arrived hours after one of the Co-op’s most powerful societies had rejected his proposals to slim down the number of people who decide how the group is run. Midcounties Co-operative, the largest of the Co-op’s societies and a major player in its own right with £1.2bn of revenues, said they would not accept Myners’ plans.

The departure comes at a critical time for the group.

Co-op Bank, which is 30 per cent owned by the Co-op, is preparing to report billions of pounds in losses tomorrow, when it publishes its long-delayed results.

Myners, a City grandee who has been chairman of Marks & Spencer, the Guardian Media Group and Land Securities, had recently published draft recommendations to give the Co-op a board structure similar to a quoted Plc but said he was “deeply troubled” by the “disdain” some board members had for the executive team.

Myners’ departure is the latest twist in a long running saga at the historic organisation.

Co-op Bank was turned over to a pack of American hedge fund investors last year to help fill a £1.5bn capital shortfall in its balance sheet.

A subsequent newspaper probe into the personal life of its chairman, Reverend Paul Flowers, led to his arrest on drugs charges and he was forced to step down in disgrace.

Only last month, the bank reported that it needed a further £400m to help it pay for charges related to past misconduct.

The split at the Co-operative Group was laid bare in March when Sutherland blasted Co-op board members on Facebook for leaking plans of his pay package to the press. He resigned a day later.

The company declined to comment last night.