EU planning a clampdown on high frequency trading

EUROPEAN politicians are today expected to approve new measures to restrict high frequency trading firms (HFTs), which use super fast data connections to profit from movements in security prices.

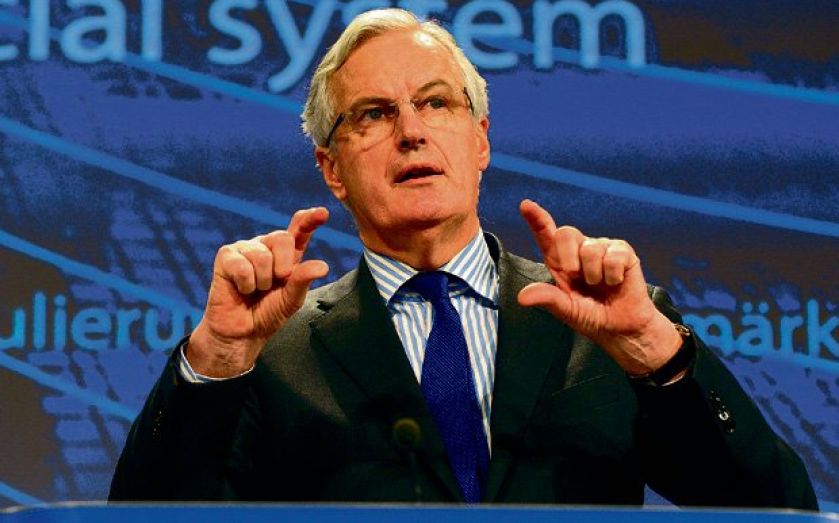

“With these rules the EU is putting in place one of the strictest set of regulations for high frequency trading in the world,” said European Union’s financial services chief Michel Barnier yesterday.

The new rules, first proposed in 2012 and expected to pass today, include restrictions to ensure price increments do not become too small, a practice that its critics claim has “led to a race to the bottom” for trading platforms trying to offer the smallest price increments in order to appeal to HFTs.

Supporters of the practice argue that there is nothing wrong in any of this, and any meaningful restrictions on the industry will reduce liquidity in the market, increasing the costs to consumers and firms seeking to raise financing.

Mandatory testing of the trading algorithms used by HFTs could also be introduced and the legislation gives the EU power to regulate the algorithms at some point in the future.

The directive also includes rules mandating traders to stay in the market for a certain period of time after they have quoted buy or sell prices to prevent volatility.

“Although HFT trading might bring some benefits, we need to make sure that it doesn’t cause instability,” added Barnier, who has championed the new rules. Even if passed today, the regulations are unlikely to come into force for another three years.

In January the FIA European Principal Traders Association, a group that represents HFTs, said that the proposal strikes a reasonable balance of restrictions on traders, marking a political accord over the law.

Author Michael Lewis’s latest book Flash Boys – which focuses on HFTs – has brought the firms back into the limelight.

Q and A: High frequency trading explained:

Q What is high-frequency trading?

A High-frequency trading uses algorithms to understand multiple markets at the same time. Traders use powerful computers to stay on top of a number of complex transactions at once.

Q What does the new EU directive do?

A The new rules, expected to pass today, will include restrictions on price increments, supposedly to avoid a race to the bottom among trading platforms seeking to appeal to high-frequency traders. Mandatory testing of the algorithms used could also be introduced. Traders could also be forced to stay in the market for a set period of time after quoting buy or sell prices, in order to prevent volatility.

Q When could the new rules come in to force?

A The rules are unlikely to come into force for at least three years. The EU financial services chief Michel Barnier said: “Although HFT trading might bring some benefits, we need to make sure that it doesn’t cause instability.” But that will be scant comfort for the more combative industry players, who believes it is being unfairly targeted.