Finland’s Metso rejects Weir’s takeover offer

FINNISH rock-crushing firm Metso rejected rival engineering company Weir’s takeover offer yesterday, on the grounds that it “is not in the best interest of Metso shareholders”.

FTSE 100-listed Weir said it “continues to believe that there is a compelling strategic rationale for bringing the two companies together” but said that there is no certainty it will revise the terms of its offer, which would have created a dual-listed company worth £8.5bn.

“The Metso board remains extremely positive and confident in Metso’s standalone growth and value creation prospects by pursuing its current strategy,” said the Helsinki-listed firm.

Weir’s takeover bid would have helped the firm expand its mining arm and was hoped by analysts to mark the return of M&A activity in the industrial sector. Canaccord Genuity analysis said the tie-up could have produced €300m (£247m) in savings.

But Finland’s state investment fund Solidium, which holds an 11 per cent stake in Metso, very quickly spoke out against the deal.

“I don’t think this is the right time to sell Metso to Weir Group, or to sell it to anyone,” Solidium’s Kari Jarvinen said.

There is now a risk Weir will become a takeover target itself, from large players such as General Electric that want to capitalise on the company’s strong position in US shale.

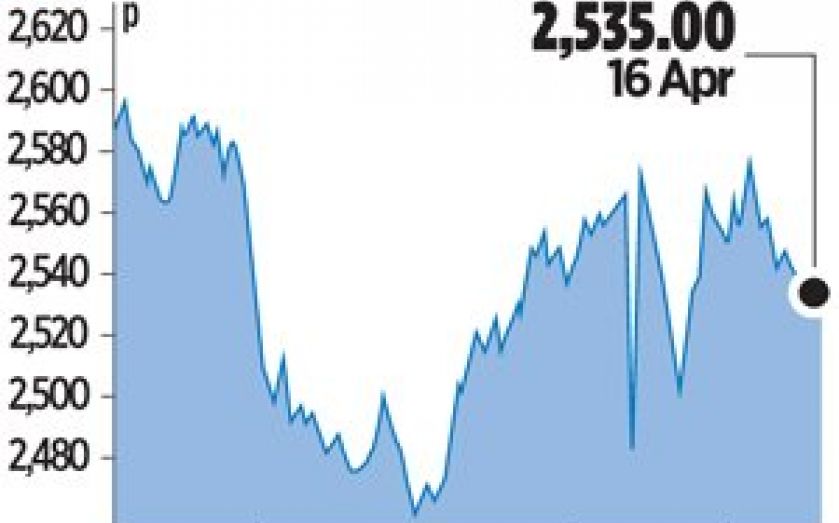

Shares in both companies fell yesterday. Weir’s closed 0.2 per cent lower.

BEHIND THE DEAL

BANK OF AMERICA MERRILL LYNCH | PETER LUCK

1 Luck attended the Royal Military Academy at Sandhurst in Berkshire and was part of the Royal Dragoon Guards.

2 He previously worked at UBS, but was one of a few people at the Swiss bank who were poached by Bank of America in 2012. He was appointed managing director on its corporate broking team.

3 Luck has worked on a number of high-profile industrial deals, advising Royalty Pharma on its hostile £5.2bn bid for Elan last year and Weir Group on its £326m offer for SPM Flow Control.

Also advising…

Philip Noblet was another key player on the Bank of America Merrill Lynch team. UBS was also advising Weir, led by Tim Waddell. Brunswick Group was giving Weir public relations advice, led by Patrick Handley.