Riverstone float raises £760m in muted debut

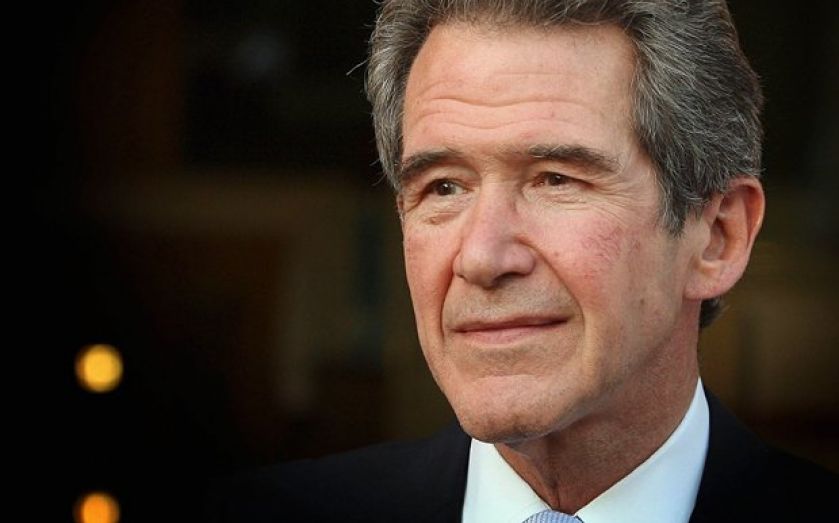

RIVERSTONE Energy, the new investment vehicle where former BP boss Lord Browne is a partner, raised £760.3m from its London listing – at the lower end of its expected price range.

The company had hoped to raise between £670m and £1.5bn from the public offering, but ended up adding just £210m to the £500m it raised prior to the flotation from cornerstone investors and the £50m from Riverstone Holdings.

It is understood that the company is happy with the value raised, which was in line with internal targets.

Shares, which were sold at £10 each, opened flat and fell six per cent in early trading, before closing at 949p.

Lord Browne, former boss of oil major BP, is a partner at Riverstone Holdings and has taken a board seat at Riverstone Energy, marking his return to the UK’s public markets after leaving BP in 2007.

Sir Robert Wilson, chairman of Riverstone Energy, said: “The interest shown by both institutional and cornerstone investors is a strong endorsement of the investment proposition and we are now fully focused on delivering the strategy we outlined at the initial public offering.”

David M Leuschen and Pierre F Lapeyre Jr, founders of Riverstone, added: “Riverstone Energy will provide a unique entry point into differentiated exploration and production and midstream investments across the global energy sector, including those benefitting from the North American energy revolution.”

Riverstone is also a part-owner of privately-owned shale gas explorer Cuadrilla, of which Lord Browne is chairman.

Goldman Sachs and JP Morgan ran the offering and acted as joint bookrunners with Deutsche Bank and Morgan Stanley.