Goldman Sachs says global investors are at risk because of this fundamental bias

Choosing where to put money is a tricky process – a case of weighing up the potential returns and risks of a myriad of possible investments.

And many of the financial professionals we trust to deal with this problem are suffering from a fundamental bias, according to a note from US investment bank Goldman Sachs.

While Goldman suggests that portfolios should be allocated proportional to the global share of each country’s stock market, asset managers are failing to do this – instead choosing to invest disproprtionately in their home countries.

Trade barriers are no longer a likely culprit. Goldman says this continues despite decades of financial liberalisation, which have "removed obstacles to capital mobility around the world" while technology has enabled more efficient trading, and information flows have become "considerably more fluid."

Perhaps asset managers feel that they know domestic markets best, but even then the strength of what Goldman call "home bias" is astounding. It's also a very real threat to portfolios, which as a result are far less diversified than they would be with more cross-country holdings.

Goldman analysts estimate that US markets capture slightly less than 40 per cent of global capitalisation, and as such US investors should put approximately 60 per cent abroad – but Goldman's numbers imply that they only hold around 16 per cent of their investments in offshore markets.

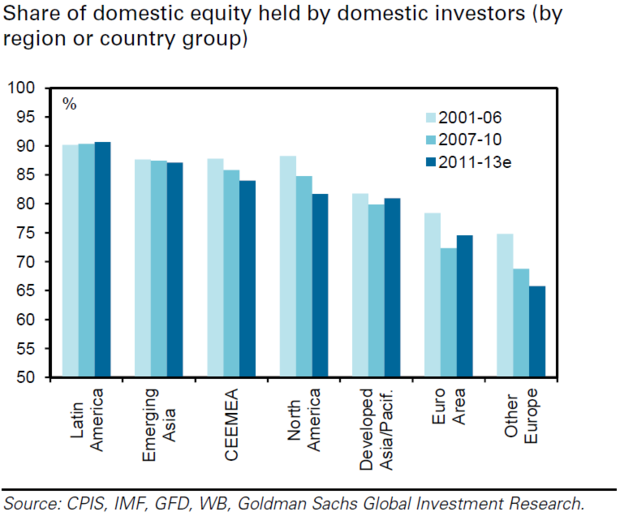

In developed markets, Goldman sees roughly 76 per cent of broadly-defined domestic equity holdings as being held by domestic investors. In emerging markets, the proportion is even higher, at close to 88 per cent.

Analyst Jose Ursua says that over the medium run, this phenomenon "can either be a curse or a blessing", depending on where shocks originate. But over the long run, high levels of home bias "are likely to reveal diversification pitfalls that could be damaging for global investment portfolios."