| Updated:

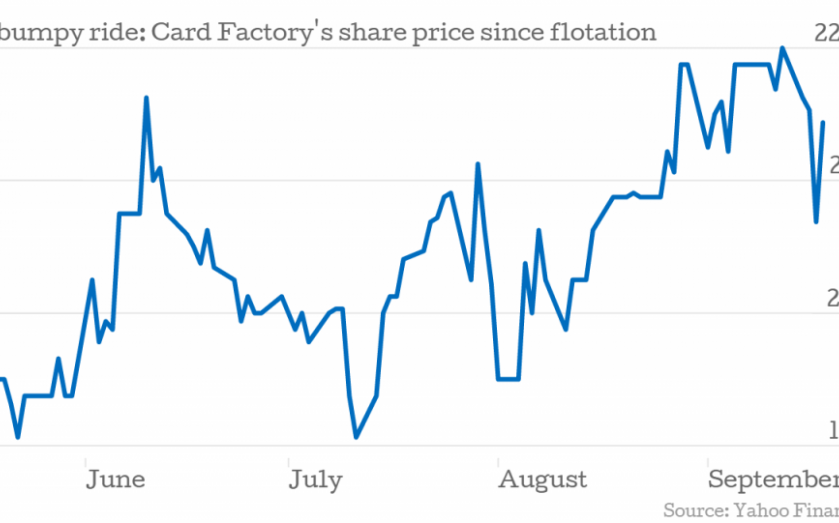

Card Factory share price up as it reports rise in underlying profit after IPO

Card Factory released its half-yearly report today, showing underlying profit before tax at £14.9m for the first half of its 2015 financial year, up from £1.8m in the first half of 2014.

But the group made a loss, as the cost of its May 2014 IPO and debt-refinancing issues forced it £7.9m into the red.

Richard Hayes, chief executive, commented:

Having completed our flotation on the London Stock Exchange earlier this year, it is pleasing to report a strong set of maiden interim results. We continue to deliver on each of our four pillars of growth – growing like-for-like sales; rolling out new stores; delivering business efficiencies; and increasing our online business.The continued growth and further improvement in our retail proposition is particularly satisfying given that this was achieved during a period in which we completed the IPO process. This reflects the strength of the whole Card Factory team and their support and commitment is greatly appreciated and valued by the Board.

Its major non-recurring cost was the IPO – £3.6m was charged to the income statement and £1.6m was recognised within share premium as costs directly related to the issue of new shares.

Share price rose 2.9 per cent in early trading, as the markets looked to have reacted positively to the news.