Holcim says there is big interest in disposals as profits plummet

SWISS cement company Holcim said yesterday that there is “huge” interest in the assets it would need to sell ahead of its merger with France’s Lafarge, as it posted a 57.5 per cent fall in first-quarter profit.

The two firms announced a share-for-share deal earlier this month, which would create a self-proclaimed “merger of equals” with sales of €32bn (£26.5bn).

To comply with antitrust regulations, the firms plan to sell off €4.9bn of assets.

Holcim said there was plenty of interest for the assets from players in mature and emerging countries, as well as private equity.

“We have a very attractive divestment portfolio and we will be very successful in placing these assets into the market,” said chief financial officer Thomas Aebischer.

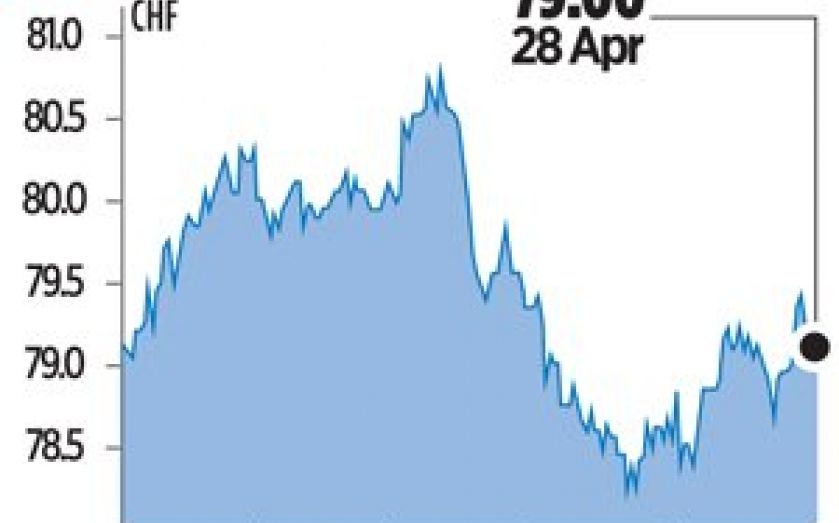

Net profit in the first quarter fell 57.5 per cent to SFr80m (£54m), hit by adverse currency movements and a tough comparison to the previous year, when first-quarter results were boosted by the sale of its 25 per cent stake in Cement Australia. Sales over the period fell 5.4 per cent to SFr4.09bn.