Standard Life misses targets as staff leave

INSURANCE giant Standard Life yesterday announced lower-than-expected new business sales, which analysts pinned on the departure of key staff members over the summer.

Star fund manager Euan Munro jumped ship to be chief executive at Aviva Investors this summer, causing some leading investors to withdraw their money from the GARS fund that he controlled.

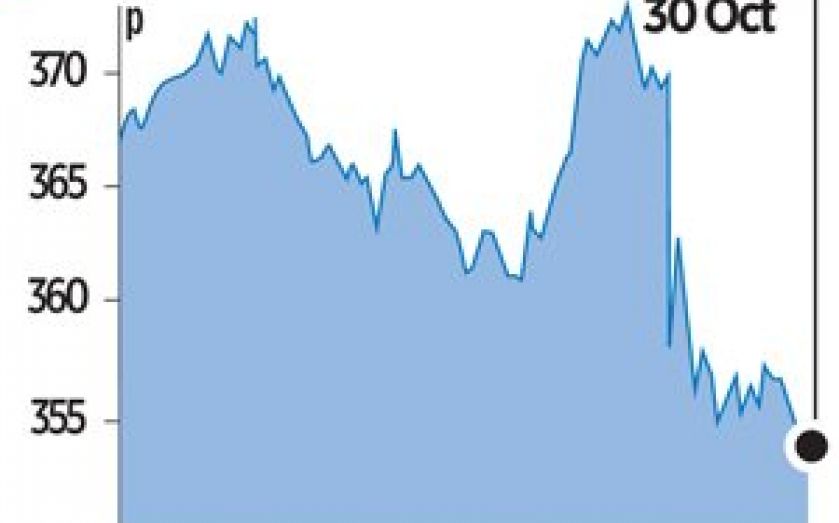

As a result Standard Life’s net long-term savings income between July and September was a quarter lower than expected at £2.7bn, pushing shares in the company down more than two per cent yesterday.

“Most of the miss was due to the lumpy institutional pensions business which to some extent also relies on GARS success,” said Abid Hussain, an analyst with Societe Generale, who also raised questions about the impact that a proposed cap on pension fees could have on Standard Life.

“We are increasingly concerned that revenue margins may be compressed in what is an already skinny margin business reliant on volume.”

However, the results update follows an exceptionally strong start to the year and Standard Life said it has seen substantial benefits from new rules requiring companies to automatically enrol their employees into a pension scheme.

“We have assisted employers with over 100 auto-enrolment implementations and have increased the number of corporate pension customers to 1.4m, adding 195,000 new customers,” said chief executive David Nish.