The end is near for Norway’s housing boom

Norway's prolonged housing boom may be coming to an end according to Capital Economics. The London-based consultancy believes that a total collapse in house prices is unlikely, but the slowdown in the housing market suggests the economy may deteriorate more than had been expected.

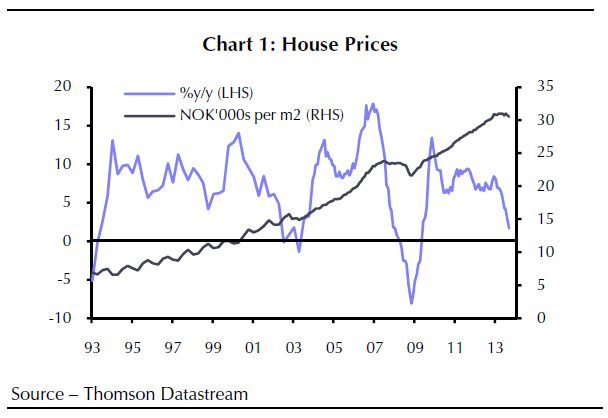

Annual Norwegian house price inflation fell from 8.4 per cent to 1.7 per cent between January and October. Capital Economics highlight the fact that house prices and debt levels are now very high relative to incomes. Although this was true in 2009, the Norges Bank reduced interest interest rates by four percentage points, which dramatically reduced household debt servicing costs.

This option is no longer available to the Norges Bank which has kept the interest rate at 1.5 per cent, and is therefore unable to administer the same policy it did in 2009.

Household wealth is no longer rising and borrowing costs are unlikely to fall. Capital Economics suggests households will need to slow their pace of borrowing and start to deleverage in the years to come. They warns that the construction sector's share of employment, which has risen for six to eight per cent, may begin to shed workers.

Consumption has risen by only 0.2 per cent in the second quarter – the smallest quarterly increase since the first quarter of 2011. The fall in house prices will be less dramatic than previous slowdowns, as the supply of new housing has fallen behind population growth. There are also strong prospects for other parts of the economy to expand such as the energy sector. But the firm maintains that the consensus view is overly optimistic.

James Howat, European economist:

Overall, consensus and official forecasts still look too optimistic despite a number of downward revisions in recent months. We expect Norwegian GDP growth of around 1.5% in 2013 and 2014, compared to the Norges Bank’s forecast of 1.8% and 2.3%. As a result, we expect the Bank to push back the first rise in interest rates from mid-2014, its current projection, to the end of next year at the earliest.