Slowdown in US mortgage applications

The number of mortgage applications in the US fell last week by seven per cent, according to the Mortgage Bankers Association (MBA). The fall came after a 6.4 per cent increase in applications the previous week and signifies, says Capital Economics, "further evidence of a moderation in the rate of the housing recovery."

Ed Stansfield, chief property economist at Capital Economics, says that if the wider economic recovery picks up, as expected, next year, mortgage applications will follow.

The index measuring applications for mortgages to buy new homes fell 5.2 per cent. Applications for home purchase were weaker (falling by 3.4 per cent) but the strength of refinancing numbers means that total activity in the market strengthened in October, despite the setback of the past week.

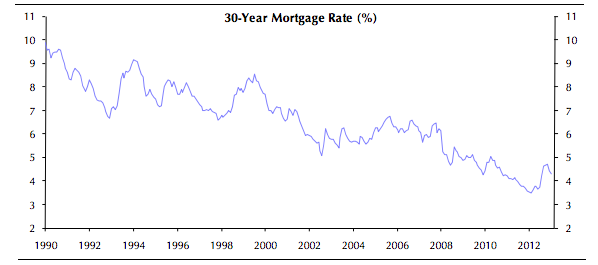

Capital Economics stresses that mortgage interest rates remaining low is key for supporting activity, pointing out that, although mortgage rates are around 0.8 percentage points higher than lows seen at the beginning of the year, they have dropped by almost 0.5 percentage points since late August, so are currently quite low.

It is possible, says Stansfield, that government shutdown last month may continue to introduce added volatility into mortgage applications data for a period of time. But he stresses that uncertainty around the debt ceiling, along with muted labour market data, help explain, more fully, the dip in demand. He adds that "favourable fundamentals facing the market point to a gradual strengthening in mortgage approvals through the course of next year."

(Capital Economics)