US economy adds more jobs than expected in October

"First Friday" jobs day is back in the US with nonfarm payrolls jumping up 204,000 in October, after analysts predicted a 125,000 gain, and a previous figure of 163,000 (revised up from 148,000).

The unemployment rate in October was up 7.3 per cent, in line with expectations – up from September's 7.2 per cent increase.

It seems that the government shutdown has very little impact on payrolls, with manufacturing increasing 19,000, construction by 11,000 and retail by 44,000. Federal employment fell by only 12,000, because workers affected by the shutdown were paid when they returned, so they were counted as employed in the establishment survey.

On the other hand, points out Paul Ashworth, chief US economist at Capital Economics, the alternative household survey has a different definition for employment. As a result, those Federal workers were not counted as employed or in the labour force, explains the 720,000 fall in the labour force and the 735,000 drop in the household survey measure of employment. This is why the unemployment rate shifted up, and the participation rate plummeted from 63.2 per cent to 62.8 per cent. Because Federal employees are now back at work, though, all of this will be reversed in November's report.

Personal income rose 0.5 per cent in September, the same as in August (expected up 0.3 per cent). Average hourly earnings in October rose only 0.1 per cent, also the same as in August, and down on the expectation of a 0.2 per cent rise. Paul Dales, senior economist as Capital Economics, comments that the personal income data is a good omen good for US consumption in the fourth quarter.

Ashworth says that, along with the news yesterday of a stronger 2.8 per cent gain in third-quarter GDP growth, "the Fed now has the data to justify making its first reduction at December's FOMC meeting, but whether it will or not is still unclear. Frankly, given all the flip-flopping, it's hard to know exactly what evidence would satisfy the majority of Fed officials."

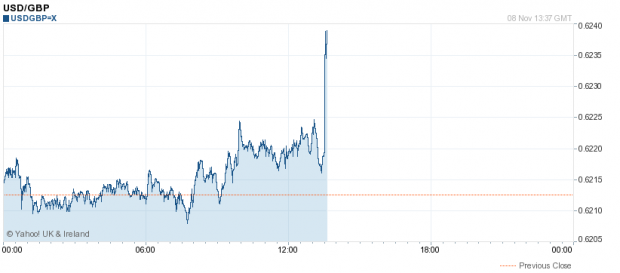

The dollar surged on the news, whilst bonds dipped:

Berenberg's Robert Wood said that as growth gains momentum, a portion of discouraged workers should return to the labour force, "allowing the Fed to keep interest rates very low for a significant time to come." But, he adds, "the further the participation rate falls and the longer it stays low, the bigger the risk that it will not rebound, forcing earlier US policy tightening. With continued support from the Fed, US growth should continue pick up next year and feed through to stronger jobs data."