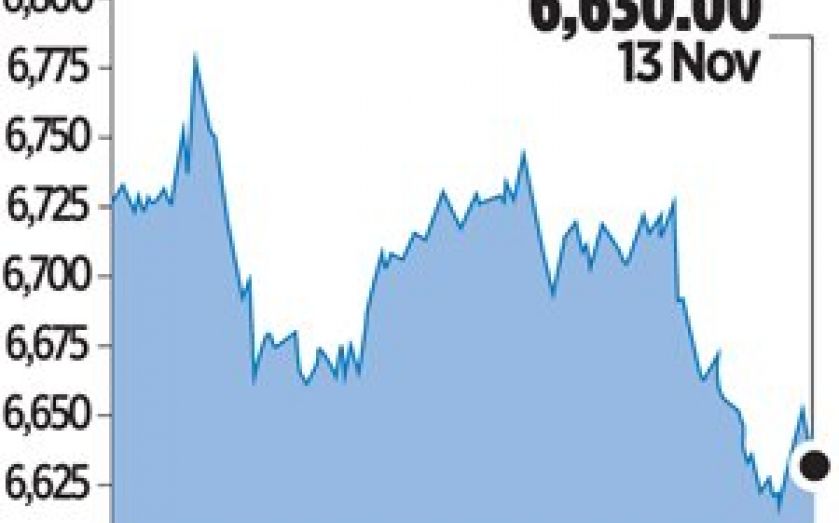

London Report: FTSE dives over rates rise fears

BRITAIN’S benchmark equity index had its worst one-day fall since mid-August yesterday, weighed down by weaker financial stocks and the possibility the Bank of England may raise interest rates earlier than forecast.

Nevertheless, several investors felt the stock market would recover from any pullback in November to end 2013 on a stronger note.

The blue-chip FTSE 100 index closed down by 1.4 per cent, or 96.79 points, at 6,630.00 points – marking its biggest one-day fall since declining 1.6 per cent on 15 August.

The FTSE 100 fell to session lows after the Bank of England issued its inflation report. The central bank’s monetary policy committee gave an upbeat assessment for the British economy, saying the unemployment rate would fall to seven per cent late next year, much earlier than previously expected due to a strengthening economic recovery. However, this also meant investors speculated that interest rates could in turn also rise sooner than previously expected up from their current record low of 0.5 per cent.

Financial stocks took the most points off the FTSE 100, with insurer RSA the worst performer. Standard Chartered also fell 2.5 per cent.