BHP mulls sale of its Australian nickel business

BHP BILLITON yesterday said it was considering selling off its nickel business in western Australia, as the miner pushes ahead with plans to streamline its portfolio.

“The review is considering all options for the long-term future of Nickel West, including the potential sale of all or parts of the business,” said the firm.

The asset potentially on the block comprises three mines, a smelter, concentrator and refinery, which Investec analysts value at $700m (£417m).

BHP’s chief executive, Andrew Mac-kenzie, has been looking to slash costs and divest non-core assets since taking on the role last year, to improve the FTSE 100 firm’s balance sheet during a lull in the commodities cycle.

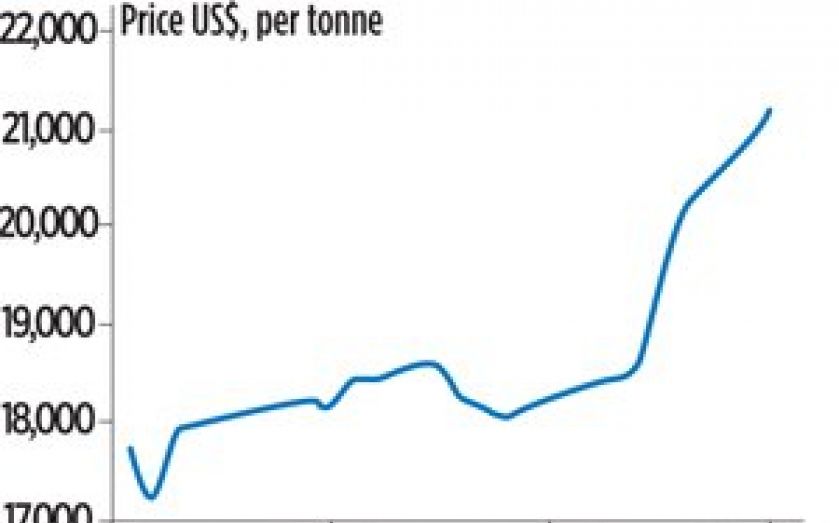

By selling the assets now, BHP would be taking advantage of a sudden surge in nickel prices. A recent export ban in Indonesia, one of the world’s largest producers of nickel, has caused the previously-unloved metal to become one of the star performers in the commodities sector. Russia is another key producer, giving prices an extra boost due to concerns about the crisis in Ukraine.

It is understood that X2 Resources, the investment vehicle set up by former Xstrata boss Mick Davis, would potentially be interested in buying the nickel business, which fits X2’s criteria of being an operational asset with an industrial commodity.

However, X2 declined to comment.

Glencore Xstrata, which has also been mooted as a possible buyer, declined to comment, too.

Shares closed 1.53 per cent higher.