Pfizer boss woos fund managers in Astrazeneca battle

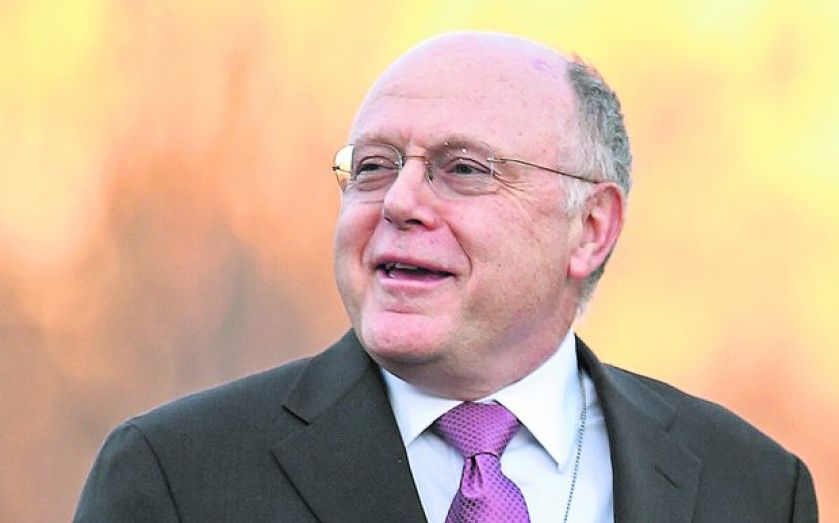

THE BOSS of the American drug giant hoping to snap up UK rival Astrazeneca will go on a whirlwind tour of City shareholders today to discover how much it will have to pay to buy the British company.

Ian Read, who yesterday faced a second grilling from MPs in Parliament, will sound out a dozen or so Astrazeneca shareholders, including BlackRock, Jupiter Fund Management and Woodford Investment Management to gauge how much he will have to pay to secure their support for a takeover.

Astrazeneca’s board and management, led by chief executive Pascal Soriot, rejected a £50-a-share offer earlier this month, but it is widely expected that Pfizer will return with another bid. Astrazeneca shares closed at £46.54 yesterday.

“Pfizer is not going to go away,” one institutional fund manager who owns a small stake in Astrazeneca, said. “It will come down to price.”

Read yesterday dismissed claims by Soriot that a merger would delay drug development. “There is no truth to any comment that some products of a critical nature would be delayed,” Read said.

Soriot and the Astrazeneca board have so far refused to meet with their Pfizer counterparts to discuss a takeover. Winning the backing of institutional shareholders could, however, force them to the table.

Without a recommendation of the Astrazeneca board, led by Leif Johansson, a further bid by Pfizer could turn hostile.