Centamin slides as lower gold output causes earnings to fall

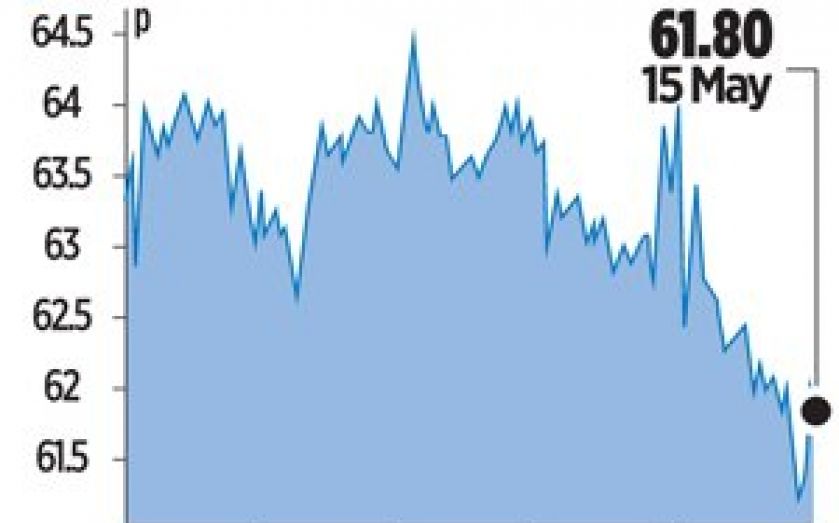

SHARES in Centamin slumped over three per cent yesterday, after the gold miner’s quarterly update showed lower production that led to higher cash costs.

The FTSE 250-listed gold miner said core earnings were down 25 per cent quarter-on-quarter and 58 per cent year-on-year to $34.4m (£20.5m). Production fell 19 per cent quarter-on-quarter to 74,241 ounces, with a cash cost of $744 per ounce.

But it said full-year guidance remains unchanged at 420,000 ounces at a cost of $700 per ounce.

“Despite the recent gold price weakness, the operation remains relatively low cost and, with capital expenditure set to reduce significantly as the…expansion programme is commissioned, is set to deliver substantial free cash flows for the remainder of the mine life,” said chair Josef El-Raghy.

Revenue fell to $102.7m in the quarter, down from $111.2m in the previous quarter and $138.2m year-on-year.

The company recently drew closer to the end of a long-running court battle over the validity of an exploration licence in Egypt, after change to a law in the country came into effect last month.

The new ruling will restrict third parties from challenging contractual agreements between the Egyptian government and investors, which appears to encompass pending lawsuits.

Shares closed 3.36 per cent down.