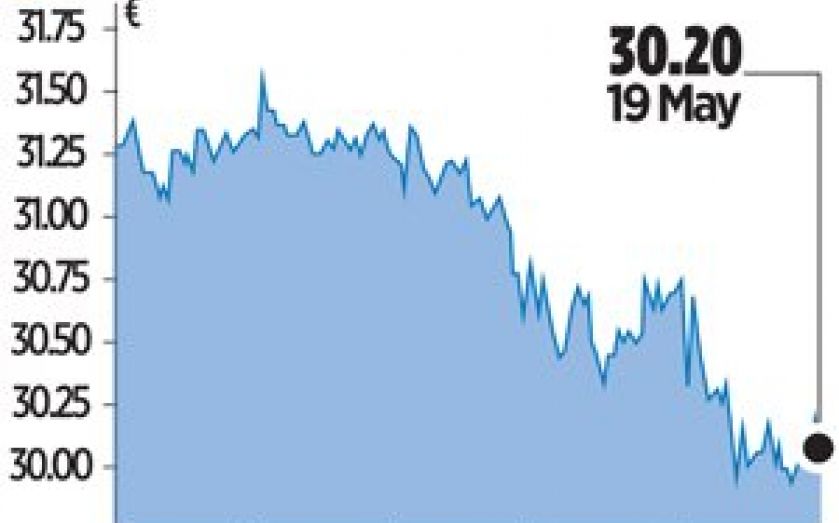

Deutsche Bank slips after plan to raise €8bn

SHARES in Deutsche Bank slid yesterday as investors and analysts poured cold water on the lender’s plan to shore up its balance sheet with an €8bn (£6.5bn) capital raising.

The German bank’s fundraising, announced late on Sunday, will see it offer €6.3bn to investors via a rights issue, in addition to €1.75bn that has already been placed with the Qatari royal family.

But though analysts cheered the new funds, they raised doubts that the money would be enough to offset structural weakness at the bank.

“We now believe that this latest capital increase is sufficient to meet regulatory requirements including future litigation expenses,” said Shailesh Raikundlia at Espirito Santo. “However, the question remains whether the pressure on FICC [fixed income, currencies and commodities] revenues is cyclical or secular.”

Ratings agency Fitch also said it expected further pressure on the bank’s fixed income trading, after a weak performance that dragged down Deutsche’s 2013 securities business during 2013.

As it seeks to shore up its balance sheet and increase its core equity Tier 1 ratio – which should rise to 11.8 per cent from 9.5 per cent as a result of the capital increase – Deutsche Bank is also facing a raft of potential litigation expenses, on top of €5bn already paid out over the past two years.

At the end of March the bank said it had set aside €1.8bn to cover potential fines or settlements, but that there was a further €2bn of risks that was not yet accounted for in the books.

Shares slipped 1.74 per cent yesterday to close at €30.20.