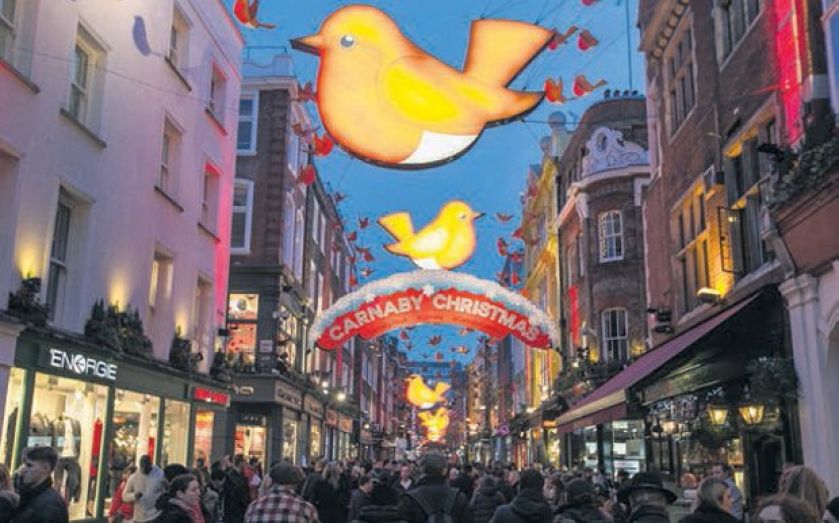

Shaftesbury reaps the benefits of a buoyant West End market

WEST END landlord Shaftesbury enjoyed a 47 per cent jump in profits in the first half, buoyed by tourists and Londoners flocking to its restaurants and shops in the West End.

The company, which owns 575 properties around Carnaby Street, Covent Garden, Chinatown, Soho and Charlotte Street, said pre-tax profits rose to £120.5m in the six months to 31 March compared with £81.8m last year.

Net income from its properties rose 8.6 per cent to £39m while Shaftesbury’s net asset value – a key industry measure – was up 5.1 per cent to £5.96 per share, beating analyst expectations.

Chief executive Brian Bickell said: “In our West End locations, demand for accommodation continues to be healthy, resulting in steady and sustained growth in rental income and low levels of vacancy.”

The group tapped investors for £156.6m in March to fund its latest buying spree, which included buying retailer Jaeger’s offices on Broadwick Street for £31m. It also bought Newport Sandringham building in Chinatown for £54m.