Real wages could resume fall as “Easter effect” sees inflation jump to 1.8pc

We've only had a month of confirmed real wage growth.

Now a sharp increase in inflation this April threatens to see us returning to falling real pay packets.

Figures from the Office for National Statistics today show inflation up from 1.6 per cent to 1.8 per cent in the year to April.

An increase had been widely anticipated, with analysts suggesting we'd see inflation rise to 1.7 per cent. In a preview of the release, HSBC noted that "the Easter effect" would be responsible for an increase in CPI, as consumers faced higher prices for seasonal items.

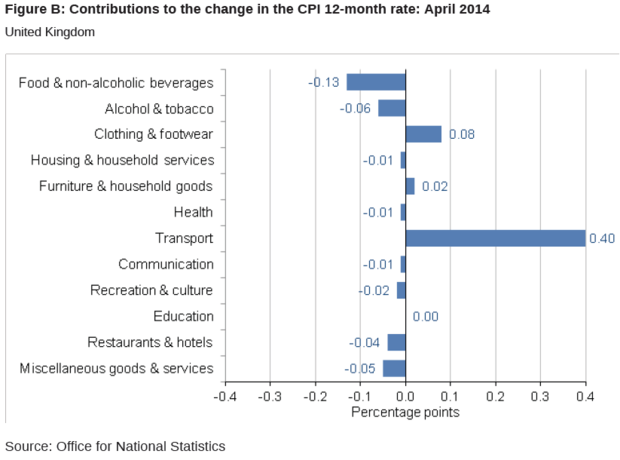

The ONS noted in its release that "increases in transport costs, notably air fares, sea fares and motor fuels, provided the largest contribution to the rise in the rate."

Data released for the month of March marked the first real earnings growth in the UK since this briefly occurred in 2010, as wage growth outstripped inflation. The last sustained period of real wage growth ended in 2008.

Total average earnings rose by 1.7 per cent in the three months to March on the same period last year, with earnings excluding bonuses up by just 1.3 per cent. The next release of earnings data could now see wages slip below inflation.

However, wage growth in March was likely to be suppressed by some one off effects in March, partly as a result of tax changes. As a result, HSBC analysts suggest that annual growth in total pay could begin to "pick up more sharply" in future months.

April marks the fourth successive month of inflation below the Bank of England's two per cent target. IHS Global Insight's Howard Archer said in a preview of the release that the four-and-a-half year low in March may be the lowest inflation seen this year, but that it "seems likely to remain below two per cent until the end of the year."

IHS Global Insight sees inflation remaining close to two per cent during much of 2015, and edging up to 2.3 per cent by the end of 2015 "in reaction to extended improved economic expansion and strengthening nominal wage growth."

The figures also imply that slack in the economy is falling, as the latest ONS estimates see core inflation rising to two per cent. Rob Wood, chief economist at Berenberg, says that "a range of measures suggest there is not much [spare capacity] left".

If data continues to paint such a picture, then pressure on the Bank of England to start tightening policy may mount.