Banks fined for euro and yen rate fixing

TRADERS from eight global banks colluded from 2005 to 2010 to attempt to alter euro and yen derivatives rates, the European Commission said yesterday, fining them a total of €1.7bn (£1.4bn).

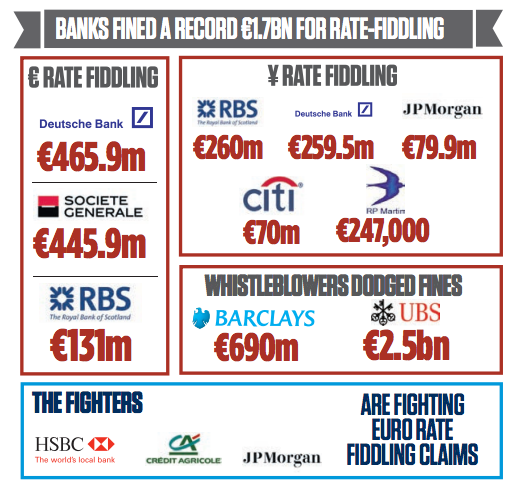

Deutsche Bank led the field with fines totalling €725.4m, followed by Societe Generale on €455.9m and RBS at €391m.

JP Morgan was hit with a €79.9m settlement, Citigroup with €70m and RP Martin at €247,000.

Barclays would have faced a bill of around €690m and UBS €2.5bn, but both blew the whistle on their cartels and so were granted immunity.

The cases are still not finally settled – JP Morgan, HSBC and Credit Agricole are fighting claims they were colluding in the Euro rates markets.

“What is shocking about the Libor and Euribor scandals is not only the manipulation of benchmarks, which is being tackled by financial regulators worldwide, but also the collusion between banks who are supposed to be competing with each other,” said European Commissioner Joaquin Almunia.

“Healthy competition and transparency are crucial for financial markets to work properly, at the service of the real economy rather than the interests of a few.”

The Commission found a cartel in the euro interest rate derivative market between September 2005 and May 2008.

And it found seven instances of bilateral collusion lasting from one to ten months from 2007 to 2010.

RBS’ chairman condemned the behaviour of the traders.

“We acknowledged back in February that there were serious shortcomings in our systems and controls on this issue, but also in the integrity of a very small number of our employees,” said Sir Philip Hampton.

“Today is another sobering reminder of those past failings and nobody should be in any doubt about how seriously we have taken this issue.”