FTSE dragged down by HSBC and utilities – London Report

BRITAIN’S top equity index broke a four-day rise yesterday as a drop in major utility stocks and in global banking group HSBC dragged the UK stock market lower.

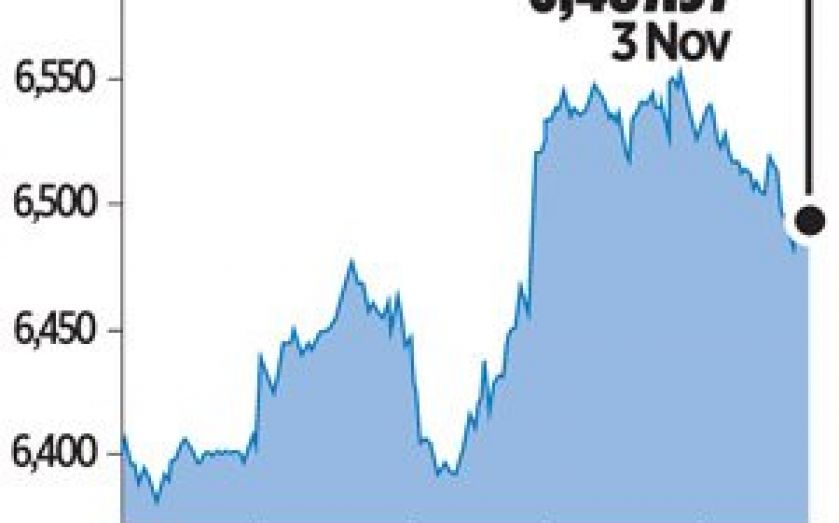

The blue-chip FTSE 100 index closed down by 0.9 per cent at 6,487.97 points. Last week, it had extended a rebound off 15-month lows reached in October.

Utility stocks dominated the list of the FTSE’s worst performers.

British Gas owner Centrica fell 2.3 per cent. United Utilities declined by 2.1 per cent, SSE fell 2 per cent while Severn Trent fell 1.6 percent.

Traders said the sector had been hit by a note from Investec, which started its coverage of United Utilities and Severn Trent with a “sell” rating.

They added that utilities had fallen out of favour as a result of last week’s stock market rebound, which led investors to prefer sectors that tend to outperform in a rising market, such as banks, over more defensive plays such as utility stocks.

“I’m still a fan of the utility stocks due to their chunky dividend yields, but I wouldn’t buy them at current levels,” Berkeley Futures associate director Richard Griffiths said.

HSBC shares fell 1.8 per cent to 627.90p after the bank missed expectations with a 12 per cent drop in underlying third-quarter earnings.

It also set aside $378m to cover a potential settlement with a British regulator for alleged manipulation of currency markets.

“The results are OK, but I wouldn’t want to buy them at these levels. I’d rather buy HSBC shares around the 600 pence level. There are still too many ongoing regulatory issues with them,” Beaufort Securities sales trader Basil Petrides said.

Among stocks outperforming the weaker overall market were budget airline EasyJet, which rose 2.7 per cent after rival Ryanair raised its profit forecast, while traders cited ongoing bid speculation as causing a 10.3 per cent jump in the shares of online grocer Ocado.

Meanwhile European shares slipped from a four-week high yesterday, with disappointing data from Europe and the United States hurting sentiment and gas transport group Snam leading the utilities sector down following a regulatory setback.

The European utilities index fell 2.3 per cent, the top sectoral decliner, hit by an 11.3 per cent drop in Snam after a regulator ruling that cut the remuneration rate for the gas storage business in 2015. Enel and Terna fell 4.2 per cent and 6.7 per cent respectively.