London house prices: Kensington and Chelsea is now growing more slowly than Bristol

London has lost its housing crown: for the first time since 2005, central London price growth is being outpaced by cities across the UK.

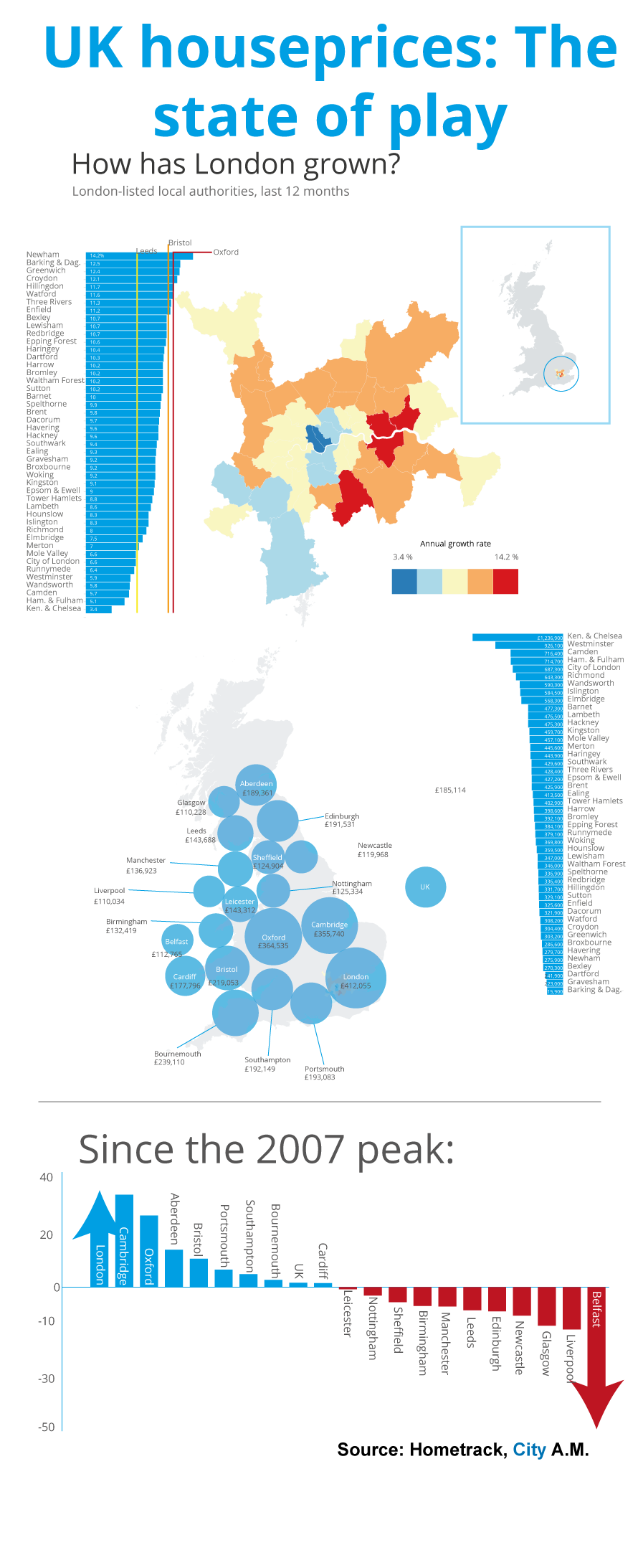

According to data from HomeTrack, the triple-threat of electoral uncertainty, mansion tax fears and affordability issues have conspired to slow growth in the country’s most-valuable areas. Boroughs such as Chelsea and Kensington and Hammersmith and Fulham have seen their growth slow (to 3.4 per cent and 5.1 per cent respectively) in the last year while other cities have grown far faster; Oxford and Bristol grew at 11.6 and 10.9 per cent respectively.

The HomeTrack data is interesting, as different statistics have shown differing attitudes to the General Election – which typically dampens demand.

The changing of the guard?

London is still the most expensive place to buy and has also reported the strongest growth since 2007’s pre-crisis peak.

Opportunities to buy in the capital?

First-time buyers find it notoriously difficult to get on the housing ladder in London. The average house price in the UK is around £186,900, while in Kensington and Chelsea it’s £1.2m and even in Barking and Dagenham, the cheapest London borough, it’s £215,900.

What HomeTrack said

Richard Donnell, director of research at residential analyst Hometrack, said

House price growth is holding up better than expected as a result of a lack of new supply of homes for sale and record low mortgage rates attracting buyers into the market.

Growth in London is still running in double digits and high capital growth rates in recent years have pushed down average loan to values in London, creating further capacity for additional borrowing for households that can pass tighter affordability tests for new lending.

As London’s first time buyers grapple over the affordability of the first rung on the property ladder, there is an opportunity to buy ahead of the curve. Boroughs such as Newham, Redbridge, Greenwich, and Barking and Dagenham offer that elusive mix of short term affordability and good capital growth in the longer term.

In short

London is still an exceptional place to buy – prices are boosted by international investors who aren’t put off by soaring prices. But there is clearly something of a backlash here, and the culprit may well be political fear – there is nothing like the prospect of a mansion tax to scare off buyers of prime central-London property.